Table of Contents

The National Payments Corporation of India (NPCI) is a non-profit entity responsible for managing retail payments and settlement systems across India. Incorporated under the provisions of Section 25 of the Companies Act 1956 (now Section 8 of the Companies Act 2013), NPCI leverages technology to enhance operational efficiency and broaden the reach of payment systems.

NPCI aims to strengthen India’s payment and settlement infrastructure, encompassing both physical and electronic transactions within the banking sector. Initially supported by ten core promoter banks, NPCI has grown to include 56 member banks from various sectors, along with new entities like payment service operators and banks regulated by the RBI.

Organization

Established in December 2008, NPCI is a not-for-profit organization owned by major banks and promoted by the Reserve Bank of India. The authorized capital is ₹3 billion (US$38 million), and the paid-up capital is ₹1 billion (US$13 million).

Initially, the 10 promoter banks included State Bank of India, Punjab National Bank, Canara Bank, Bank of Baroda, Union Bank of India, Bank of India, ICICI Bank, HDFC Bank, Citibank, and HSBC. In 2016, the ownership expanded to include 13 more public sector banks, 15 additional private sector banks, 1 foreign bank, 10 multi-state co-operative banks, and 7 regional rural banks. The Board of NPCI includes Biswamohan Mahapatra as the Non-Executive Chairman, nominees from the RBI, and nominees from the ten core promoter banks. Dilip Asbe is the current Managing Director and CEO, succeeding A. P. Hota, who retired on August 10, 2017.

NPCI International Payments Limited (NIPL)

NPCI has created a subsidiary, NPCI International Payments Limited (NIPL), to extend its products to the global market. NIPL focuses on the internationalization of RuPay and the Unified Payment Interface (UPI). It has received offers from countries in Asia, Africa, and the Middle East to improve their payment infrastructure. In 2021, Malaysian company Merchantrade Asia partnered with NIPL to facilitate remittances to India via UPI. Additionally, NIPL has teamed up with French company Lyra to enable UPI payments in France, starting with the Eiffel Tower.

NPCI Bharat BillPay Limited (NBBL)

In April 2021, NPCI established a new subsidiary, NPCI Bharat BillPay Limited (NBBL), to enhance growth, particularly in the business-to-consumer segment for small businesses. This move aims to manage the increasing traffic and workload from UPI, IMPS, Aadhaar Enabled Payment System, and National Electronic Toll Collections. NBBL is a public company established in December 2020.

Objectives of NPCI

The primary objective of NPCI is to provide the common people with an affordable and robust payment system. NPCI aims to integrate various systems into a nationwide standard retail payment system.

Also Read: Guna Caves (Devil’s Kitchen) Kodaikanal: History, Length& Mystery

Services Offered by NPCI

NPCI offers several services, including:

- Bharat Bill Payment Interface (BBPI): A platform developed to help the retail payments sector by providing a single interface for aggregators and billpayers.

- Immediate Payment Service (IMPS): Allows immediate fund transfers at any time with beneficiary details.

- RuPay: An affordable card scheme available as credit, debit, and prepaid cards, with over 300 million RuPay cards issued in India.

- USSD Services: Enables banking solutions without the need for internet or smartphones.

- BHIM: Uses UPI for payment transfers, requiring only the Virtual Payment Address (VPA) or registered mobile number.

- Unified Payments Interface (UPI): Allows fund transfers from smartphones by linking bank accounts, and facilitating direct bank-to-bank transactions.

Facing Issues with FASTag Recharge? Here’s How to File an NPCI Complaint Online

FASTags have revolutionized toll payments in India, offering a seamless and convenient way to breeze through toll plazas. But what happens if you encounter a problem with your FASTag recharge? Don’t worry, the National Payments Corporation of India (NPCI) has a mechanism for filing complaints online.

When to File an NPCI Complaint for FASTag Recharge

There are several situations where filing an NPCI complaint might be necessary:

- Recharge not reflecting: You recharged your FASTag but the balance isn’t showing up.

- Incorrect amount deducted: The deducted amount during recharge doesn’t match what you intended.

- Transaction failure: The recharge attempt failed despite having sufficient funds.

- Suspicious activity: You suspect unauthorized debits from your FASTag account.

Filing an NPCI Complaint Online

Here’s a step-by-step guide to filing an NPCI complaint for FASTag recharge issues:

- Visit the NPCI website: https://www.npci.org.in/register-a-complaint

- Click on “Register a Complaint” under the “For Users” section.

- Select “FASTag” from the “Product” dropdown menu.

- Choose the specific transaction type related to your recharge issue.

- Enter the required details, including the first six and last four digits of your FASTag number, bank name, transaction date (if applicable), and a brief description of the problem.

- Attach any relevant documents like screenshots or bank statements (optional).

- Submit the complaint.

Alternative Channels for FASTag Recharge Complaints

While the NPCI complaint portal is a convenient option, here are some other ways to address recharge issues:

- Contact your FASTag issuing bank: They can investigate the problem and provide a resolution. Bank helpline numbers can be found on the NPCI website https://www.npci.org.in/what-we-do/netc-fastag/netc-fastag-helpline-number

- National Highway Authority of India (NHAI) helpline: For issues faced specifically at toll plazas, you can call the NHAI helpline number 1033.

Frequently Asked Questions (FAQ’s)

Ans: NPCI was established in December 2008 and received its Certificate of Commencement of Business in April 2009.

Ans: The National Payments Corporation of India (NPCI) is a non-profit organization responsible for managing and operating retail payments and settlement systems in India. It aims to enhance the payment infrastructure of the country through technological innovations and efficient systems.

Ans: RuPay is an NPCI card scheme offering affordable credit, debit, and prepaid cards, enabling over 300 million users in India to make financial transactions.

Latest Blogs

- Is Shadnagar Safe for NRI Investment? The 2026 Growth & Legal Report

- Plots vs. Flats: The “5-Year Challenge” – Who Won the Jackpot? (NRI Case Study)

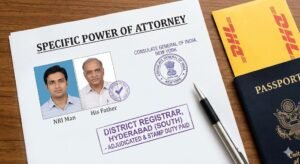

- Power of Attorney (GPA) Format for NRIs Buying Property in Hyderabad (2026 Guide)