Every homeowner in Visakhapatnam is responsible for paying property tax to the Greater Visakhapatnam Municipal Corporation (GVMC). This tax contributes significantly to the city’s development, funding essential services like sanitation, infrastructure maintenance, and public amenities.

This comprehensive guide covers everything you need to know about property tax in Visakhapatnam, from understanding the calculation to making your payments online.

What is Property Tax?

Property tax is an annual levy imposed by the GVMC on all residential and non-residential properties within its jurisdiction. It is calculated based on the property’s Annual Rental Value (ARV), which represents the estimated annual rent that could be earned if the property were rented out in its current condition.

How is Property Tax Calculated?

The formula for calculating property tax in Visakhapatnam is:

Property Tax = ARV x Tax Rate

- ARV: This value is determined by the GVMC based on factors like property location, size, age, and amenities. You can find your property’s ARV on your previous tax bill or by searching on the CDMA website using your district, ULB (GVMC), and other details https://cdma.ap.gov.in/en/ptpayments.

- Tax Rate: The tax rate varies depending on the property type.

- Residential properties: Not more than 25% of ARV

- Non-residential properties: Not more than 30% of ARV.

Rebates and Exemptions:

The GVMC offers some relief to certain property owners:

- Early Bird Rebate: A 5% rebate is available for payments made before April 30th of the financial year.

- Age-Based Rebates: Properties can qualify for deductions on their ARV based on their age:

- 25 years or less: 10% deduction

- Between 25 and 40 years: 20% deduction

How to Pay Your Property Tax Online:

Gone are the days of waiting in queues! Here’s how to make your GVMC property tax payments conveniently online:

1. CDMA Portal:

- Visit the CDMA website: https://cdma.ap.gov.in/en/ptpayments.

- Under “Property Tax,” select “Search Property Tax.”

- Enter your district (Visakhapatnam), ULB (GVMC), PTIN (Property Tax Identification Number), or door number.

- To get your data back, click “Get Property Details”.

- Follow the on-screen instructions to complete the payment using a debit card, credit card, or net banking.

2. Payment Aggregators:

Several online payment platforms like Paytm allow GVMC house tax payments.

- Visit your preferred payment aggregator’s website (e.g., Paytm).

- Search for “GVMC Property Tax” or “Visakhapatnam House Tax” under the bill payment section.

- Enter your PTIN and any other required details.

- Select your desired payment option and carry out the purchase.

Benefits of Online Payment:

- Convenience: Make payments from your computer or smartphone at any time and from any place.

- Security: Reputable online payment gateways ensure secure transactions.

- Speed: Get instant confirmation of your payment.

- Transparency: Review your payment history easily.

Important Reminders:

- Keep a copy of your online payment receipt for future reference.

- Pay your property tax before the due date to avoid late fees.

Additional Resources:

- GVMC Website: https://www.gvmc.gov.in/index.html

- CDMA Property Tax: https://cdma.ap.gov.in/en/ptpayments

By understanding the basics of property tax in Visakhapatnam and utilizing the convenient online payment options, you can fulfill your civic duty and contribute to the city’s progress efficiently.

Frequently Asked Questions (FAQ’s)

Ans: Property Tax = Annual Rental Value (ARV) x Tax Rate (residential: max 25%, non-residential: max 30%). Find your ARV on your tax bill or on the CDMA website

Ans: Yes! Get a 5% discount by paying before April 30th. Senior citizen discounts apply based on property age (up to 20% off).

Latest Blogs

- Is Shadnagar Safe for NRI Investment? The 2026 Growth & Legal Report

- Plots vs. Flats: The “5-Year Challenge” – Who Won the Jackpot? (NRI Case Study)

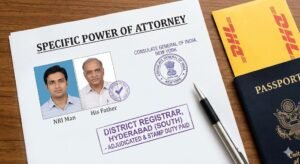

- Power of Attorney (GPA) Format for NRIs Buying Property in Hyderabad (2026 Guide)