Property taxes are a significant source of revenue for the Vasai Virar City Municipal Corporation (VVMC), crucial for maintaining and enhancing civic amenities within the area. This article provides a detailed guide on how property owners can manage their tax responsibilities efficiently, focusing on online payments, key determinants of the tax amount, penalty implications for late payments, and available rebates and discounts.

How to Pay VVMC Property Tax Online?

Paying your property tax online is convenient and ensures that you meet your fiscal obligations on time, without having to visit the municipal office physically. Here’s how you can proceed with your online payment:

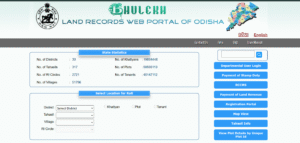

- Access the VVMC Portal: Start by visiting the official VVMC website.

- Navigate to Property Tax Section: Select the property tax option, which will redirect you to the payment page.

- Enter Property Details: Fill in the required fields such as property ID, locality, property type, and owner’s name.

Review Tax Details: The amount to be paid will be displayed on the screen. Before proceeding, confirm that all of the details are correct.

- Complete the Payment: Choose a payment method provided on the portal and finalize the transaction.

- Download Receipt: Once the payment is successful, download and print the receipt for your records.

Determinants of Property Tax in Vasai-Virar

The amount of property tax levied by the VVMC is influenced by several factors:

- Location and Zone: The property’s ward and zone significantly affect the tax rate.

- Property Size: Both the built-up and carpet area are considered.

- Property Type: Tax rates vary with the type of property, e.g., residential, commercial, industrial, etc.

- Construction Type: The materials and build quality, such as RCC or simple construction, play a role.

- Approved Rent: Rent levels approved for the area also influence the tax.

- Rateable Value Calculation: The formula used is Standard rent x Area x 12 – 10% standard deduction.

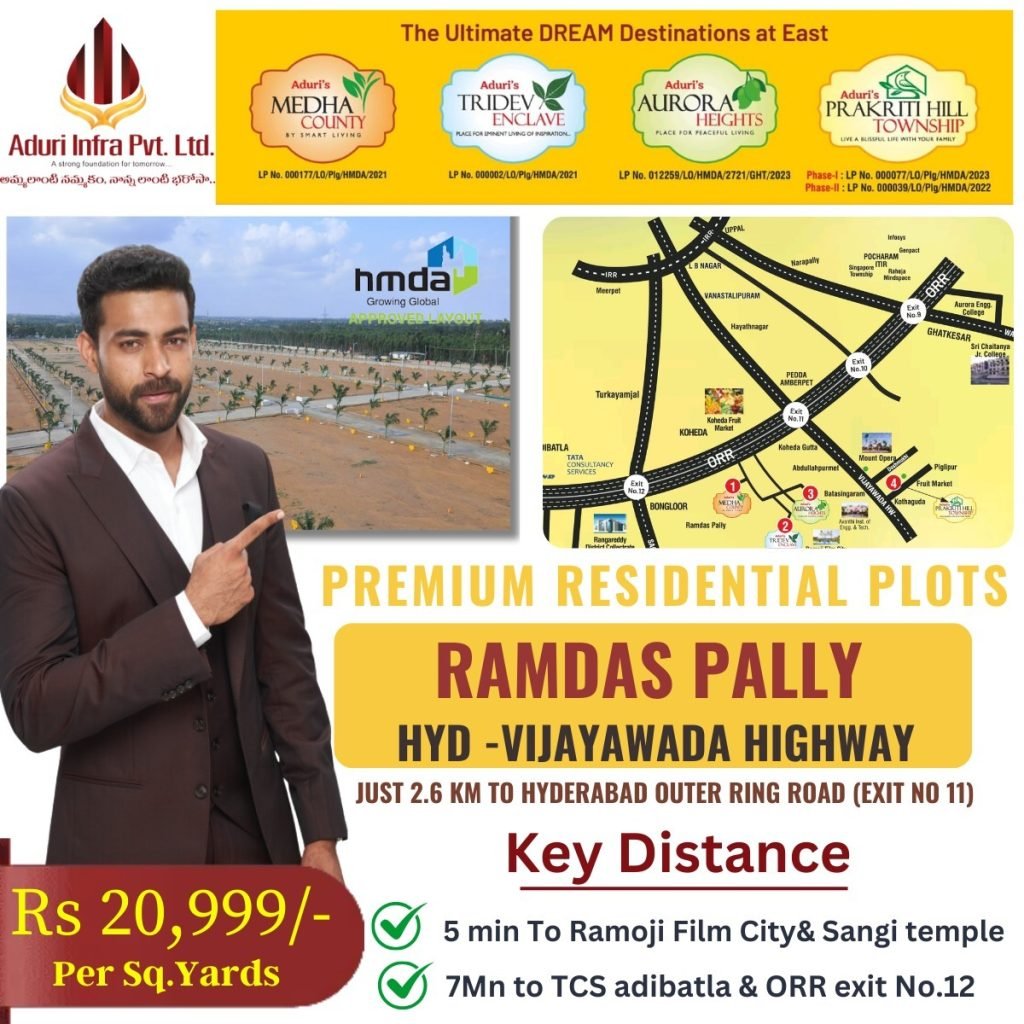

Open Plots Near Hyderabad

Deadline and Penalties for Late Payment

It’s important to note that the last date for paying your property tax without penalty is December 31 each year. Missing this deadline can lead to:

- Incremental Penalties: A 2% penalty per month is applicable for taxes unpaid beyond three months.

- Legal Consequences: Persistent non-payment might lead to legal notices, fines, or even property auctions.

Advantages of Paying Property Tax Online

Choosing to pay your property tax online offers several benefits:

- Transparency and Updates: The process is transparent, and you can easily access any updates, amendments, or resolutions regarding property taxes.

- Convenience: Online payments save time and effort compared to traditional methods.

Rebates and Discounts on Property Taxes

The VVMC offers a 15% discount to those who pay their property tax in advance for the next five years within the first 15 days of bill generation. This incentive not only reduces your tax liability but also eases the administrative burden on municipal services.

Tips for Timely Tax Payment

To avoid any penalties or charges, consider the following tips:

- Set Reminders: Ensure you remember the payment deadline by setting up calendar alerts.

- Verify Tax Amounts: Always double-check the tax amount displayed before making a payment.

- Utilize Auto-payment Options: Automate your tax payments to avoid missed deadlines.

Alternative Payment Methods

For those preferring to pay their property taxes offline, the VVCMC Head Office located opposite the Virar Police Station on Bazaar ward, Virar East, Maharashtra 401305, is available for in-person payments.

Contact Information

Should you need any assistance or clarification regarding your property tax, you can contact the VVMC helpline at 8828137832 or email propertytax.vvmc@gov.in.

Paying your VVMC property tax online is straightforward and provides a hassle-free way to ensure you’re contributing to the development and maintenance of Vasai-Virar’s civic infrastructure. By following the outlined steps, you can efficiently manage your tax payments and benefit from the available discounts and exemptions.