NRI real estate

Investing in real estate is a pivotal financial decision, and for those contemplating the Indian market, understanding the nuances between commercial and residential properties is key. This guide aims to demystify the complexities, providing insights to aid in making smart investments tailored to individual goals and preferences, with a particular focus on Non-Resident Indians (NRIs).

Commercial Real Estate: The Business Frontier

Understanding NRI Commercial Investments: Commercial real estate, spanning office spaces, retail outlets, and industrial units, holds significant appeal for NRIs seeking robust, long-term returns. The potential for high rental yields and appreciation aligns well with the strategic goals of overseas investors.

Advantages of NRI Commercial Investments:

- Stable Rental Income for NRIs: Commercial properties often offer more stable and predictable rental income, aligning with the preferences of NRIs for secure, long-term returns.

- Diversification Strategies for NRIs: NRI investors can benefit from diversification by investing in commercial real estate, which is less susceptible to market fluctuations influenced by residential market dynamics.

- Potential for Higher Returns for NRIs: While the initial investment may be higher, commercial properties offer NRIs the potential for higher returns due to increased rental values, especially in prime business locations.

Considerations and Challenges for NRI Investors:

- Higher Initial Investment for NRIs: Acquiring commercial properties often requires a more substantial initial investment, which NRIs should carefully consider in their investment strategy.

- Market Sensitivity for NRIs: NRI investments in commercial real estate are sensitive to economic trends. NRIs should be mindful of economic downturns that can impact businesses and, subsequently, their ability to pay rent.

Latest News Updates

- Bhu Bharati Portal: Telangana’s New Land Record System-Key Features & Benefits

- RBI Cuts Repo Rate to 6%: How It Affects You & the Economy

- Hydraa Takes Action: FTL Survey to Resolve Lake Encroachment Issues

- Kancha Gachibowli Forest News: A Clash Between Development and Conservation

- H-CITI Programme: Transforming Hyderabad’s Infrastructure for a Smarter Future

- Vanguard Group Sets Up Global Capability Center (GCC) in Hyderabad

Residential Real Estate: The Comfort of Home

Understanding NRI Residential Investments: Residential real estate, comprising houses, apartments, and condominiums, holds an enduring appeal for NRIs. It caters to the housing needs of individuals and families, providing a familiar investment landscape.

Advantages of NRI Residential Investments:

- Steady Demand for NRI-Owned Properties: Residential properties enjoy consistent demand, driven by the perpetual need for housing. This stability can be particularly appealing to NRIs seeking steady cash flow.

- Lower Entry Barrier for NRI Investors: Residential properties often have a lower entry barrier, making them more accessible for individual NRI investors, especially those starting in real estate investment.

- Emotional Value in NRI Residential Investments: Residential properties often hold emotional value for NRIs. This emotional attachment can foster long-term ownership and stability in rental markets.

Considerations and Challenges for NRI Investors:

- Lower Rental Yields for NRI-Owned Residential Properties: Residential properties usually yield lower rental returns compared to their commercial counterparts, a consideration for NRIs focused on maximizing their cash flow.

- Market Saturation Consideration for NRIs: In some urban areas, the residential market may experience saturation, potentially limiting opportunities for significant appreciation. NRIs should assess market dynamics carefully.

Making Informed Decisions with NRI Investment Focus:

1. Identify NRI-Specific Investment Goals: Understanding personal investment goals, especially those relevant to NRIs, is crucial. For those seeking stable long-term returns and diversification, commercial real estate may be an ideal choice. Residential properties, on the other hand, can appeal to those looking for steady cash flow with a lower entry barrier.

2. Location Matters for NRI Investments: Both commercial and residential properties are heavily influenced by location, and this consideration is particularly significant for NRIs. Assessing the potential growth, demand, and accessibility of a location is vital for a successful NRI investment strategy.

3. Diversify NRI Portfolios for Balance: A balanced NRI investment portfolio often includes a mix of commercial and residential properties. Diversification can mitigate risks and provide stability across varying market conditions, catering to the unique preferences of NRIs.

Conclusion: Tailoring NRI Investments to Vision and Preferences

Smart real estate investments hinge on aligning choices with unique visions and financial objectives, especially for NRIs. Whether delving into the dynamic realm of commercial real estate or opting for the familiar comforts of residential properties, a well-informed decision leads to a more secure and rewarding investment journey. The key lies in staying attuned to market trends, understanding personal preferences, and crafting a strategy that resonates with individual NRI goals.

Frequently Asked Questions (FAQs)

A: Factors include financial goals, risk tolerance, and market trends, influencing the choice between commercial and residential real estate investments.

A: Commercial properties often yield higher rental returns, while residential properties may offer stability and consistent demand.

A: Yes, tax implications vary, and NRIs should be aware of tax considerations associated with both commercial and residential real estate investments.

A: Location is crucial; commercial properties thrive in business districts, while residential investments depend on accessibility, amenities, and neighborhood dynamics.

A: Diversification involves balancing risk and return, strategically combining commercial and residential properties to create a resilient and high-performing real estate portfolio.

Calculators

- Is Shadnagar Safe for NRI Investment? The 2026 Growth & Legal Report

- Plots vs. Flats: The “5-Year Challenge” – Who Won the Jackpot? (NRI Case Study)

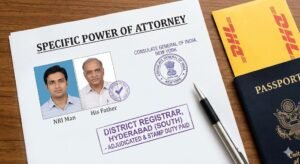

- Power of Attorney (GPA) Format for NRIs Buying Property in Hyderabad (2026 Guide)

- TDS Rates (20% vs 1%) on Property Sale by NRI: 2026 Guide

- Best Way to Send Money to India for Property Purchase (2026 Guide)

- BREAKING: No TAN Required for Buying Property from NRI (Budget 2026 Update)