Purchasing a property in Mumbai, Maharashtra involves several additional costs beyond the property price, such as stamp duty and registration charges. Understanding these costs is essential for buyers to accurately estimate the total expense of acquiring a property. This guide provides insights into the current stamp duty and registration charges in Mumbai and how the newly launched Mumbai Abhay Yojana can help buyers save money.

Stamp Duty and Registration Charges in Mumbai

When buying a property in Maharashtra, buyers must pay stamp duty and registration charges, which are taxes calculated based on the market value of the property. Stamp duty rates vary depending on the property’s location and the buyer’s gender. Additionally, there is a metro cess that adds an extra one percent to the stamp duty rate.

Mumbai’s current registration fees and stamp duty as of 2024

Stamp duty and registration charges in Mumbai differ depending on the property’s location:

- Within the municipal limits of an urban area:

- For male buyers: 6% stamp duty

- For female buyers: 5% stamp duty

- Registration charge: 1% of the property value

- Within the limits of any municipal council/panchayat/cantonment area within MMRDA:

- For male buyers: 4% stamp duty

- For female buyers: 3% stamp duty

- Registration charge: 1% of the property value

- Within the limits of any gram panchayat:

- For male buyers: 3% stamp duty

- For female buyers: 2% stamp duty

- Registration charge: 1% of the property value

Stamp Duty Concessions for Female Homebuyers

The Maharashtra government offers a one percent rebate in stamp duty for properties transferred in a woman’s name. Female homebuyers in Mumbai benefit from paying a lower stamp duty rate of 5% compared to 6% for male buyers.

Metro Cess on Stamp Duty

To fund transportation infrastructure projects, Maharashtra introduced a one percent metro cess on stamp duty effective from April 1, 2022. This cess applies to properties in Mumbai, Pune, Thane, and Nagpur, raising the overall stamp duty and registration charges.

Understanding Stamp Duty Rates in Maharashtra

The stamp duty rates in Maharashtra are among the highest in India, varying based on location and transaction type. For instance, residential properties have different stamp duty rates compared to commercial properties. Here are some current rates for different transactions:

- Sale Deed: 5%

- Gift Deed: 2%

- Lease Deed: 0.25% of the lease amount

- Mortgage Deed: 0.1% of the mortgage amount

How Stamp Duty Rates are Calculated

In Mumbai, stamp duty is calculated based on the Ready Reckoner rate. This rate varies depending on whether the property is within municipal limits, municipal council limits, or gram panchayat areas. Buyers should be aware of these rates and registration fees when calculating the total cost of a property.

Abhay Yojana Amnesty Scheme

The Maharashtra government has launched an amnesty scheme, Abhay Yojana, to alleviate the burden of penalties for insufficient or non-payment of stamp duty. This scheme operates in two phases:

- Phase 1 (1 December 2023 to 31 January 2024):

- Stamp duty due up to Rs 1 lakh: Full amount and penalty waived.

- Stamp duty due over Rs 1 lakh: 50% payable under the scheme, penalty waived.

- Phase 2 (1 February 2024 to 31 March 2024):

- Stamp duty due less than Rs 1 lakh: 80% reduction in payable duty and penalty.

- Stamp duty due over Rs 1 lakh: 40% reduction in duty and 70% reduction in penalty.

Factors Influencing Stamp Duty Charges

Several factors can affect stamp duty charges in Mumbai:

- Age and Gender: Female homebuyers receive a 1% rebate on stamp duty.

- Location: Urban areas incur higher stamp duty than rural ones.

- Type and Usage: Commercial properties have higher charges than residential ones.

- Amenities: Properties with luxurious amenities may have higher charges.

Stamp Duty Refunds in Maharashtra

Refunds are possible under certain circumstances, such as writing mistakes on stamp paper or incomplete information. Apply for a refund online through the official website and apply to the nearest SRO.

Tax Benefits on Stamp Duty Payments

Under Section 80C of the Income Tax Act 1961, expenses related to stamp duties and registration charges can be claimed as tax deductions up to Rs 1.5 lakh.

Stamp Duty and Registration Process

Buyers can pay stamp duty and registration fees online through the Maharashtra stamp and registration department’s portal or offline methods like franking and stamp paper.

Latest Updates

Recent announcements include the introduction of the Abhay Yojana amnesty scheme and discussions about the metro cess. Despite calls for its withdrawal, the Maharashtra government may maintain the metro cess to fund ongoing infrastructure projects in major cities.

For detailed information on stamp duty rates, concessions, and payment methods, buyers should consult official government websites and local authorities.

Frequently Asked Questions (FAQ’s)

Ans: Stamp duty is a type of property tax paid by homebuyers during property transactions. Registration charges are fees paid for recording the ownership change with the government.

Ans: For male homebuyers, the stamp duty rate in Mumbai is 6% (5% stamp duty plus 1% metro cess) of the market value of the property. For female homebuyers, the rate is 5% (4% stamp duty plus 1% metro cess).

Ans: Registration charges in Mumbai are 1% of the property value or Rs. 30,000 for properties above Rs. 30 lakh.

Latest Blogs

- Is Shadnagar Safe for NRI Investment? The 2026 Growth & Legal Report

- Plots vs. Flats: The “5-Year Challenge” – Who Won the Jackpot? (NRI Case Study)

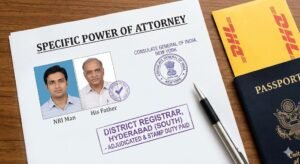

- Power of Attorney (GPA) Format for NRIs Buying Property in Hyderabad (2026 Guide)