Stamp duty and registration Fees/Charges in Gujarat

In Gujarat, the basic rate of stamp duty is 3.50%, whereas the total rate is 4.90%. In Gujarat, the registration cost is 1%. To determine it, the overall price of the property is taken into account, which includes the clubhouse, car park, energy deposit charges, and so on.

Stamp Duty & Registration Fees in Gujarat

| Stamp Duty | Registration charges |

| The basic stamp duty rate is 3.5% of the total property | The registration charge of the total property’s market value is 1% for male |

| There is a 40% premium on the property’s basic rate of 1.4%. | For females, there is no registration fee based on the entire market value of the property. |

| The total stamp duty payment is 4.9% | Registration charge is 1% on joint buyers of both male & male and male & female |

| There is no registration fee for a joint buyer who is both female and female. |

In Gujarat, how do you Calculate stamp duty?

Assume Sai purchased a home in Gujarat for Rs 86.75 lakh. The stamp duty he must pay is Rs 4,25,075.

Calculation: 86,75,000 x 4.9/100 = Rs 4,25,075.

Registration Fees for men and women in Ahmedabad, Gujarat

| Gender | Registration charge |

| For men | 1% |

| For women | No registration charges |

| For joint buyers (male and female) | 1% |

| For joint buyers (female and female) | No registration charges |

Related Blogs

Gujarat 2023 stamp duty and registration fees: Required Documents

- Title deed

- Identification of buyers and dealers

- Address proofs

- If the document falls under Sector 32A of the Gujarat Stamps Act, 1958, an application from No. 1 is required.

- Power of attorney

Also Read: Gujarat Land Records: AnyROR E-Dhara Portal Guide 2023

How to pay Stamp duty and registration charges in Gujarat 2023:

In Gujarat, you may pay your stamp duty and registration fees either offline or online. If you choose to go the traditional route, you may pay the stamp duty and registration fees at your local franking center. You can also pay the stamp duty and registration fees at the SRO. Alternatively, you can use e-stamping to pay your stamp duty and registration fees online.

Stamp duty collection in Gujarat

The Coronavirus epidemic did have a toll on the state government’s stamp duty collection. While stamp duty collection was at a low in May 2020, with only Rs 120 crore, festival season property transactions resulted in Rs 748 crore in stamp duty collection in October 2020. Meanwhile, the Gujarat branch of the Confederation of Real Estate Developers Association of India (CREDAI) has urged that the government reduce stamp duty by 2% to guarantee that buyer sentiments stay favorable through March 2021.

Electronic stamping in Gujarat

Through the Stock Holding Corporation of India Ltd, the government has made e-stamping available to everyone. When a person visits the taluka head offices in any of the districts, e-stamping certificates are immediately available. Keep in mind that e-stamping is legal.

Frequently Asked Questions (FAQ’s)

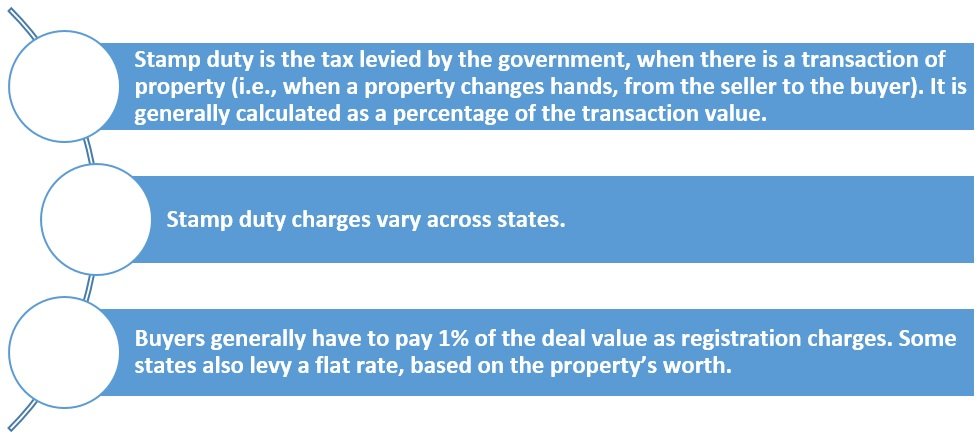

Ans: Stamp duty is based on the market value of a property, whereas registration fees are based on the cost of establishing your ownership of the property and are often less than stamp duty.

Ans: Yes, the e-stamp is valid in Gujarat.

Ans: Stamp duty and registration fees are often omitted from house loan approval.