When you acquire property in Surat, one of the critical responsibilities you inherit is paying the Surat Municipal Corporation (SMC) property tax. This tax is vital for funding numerous public services and infrastructure improvements within the city. This detailed guide aims to simplify the complexities of SMC property tax, covering everything from payment methods to potential exemptions and rebates.

What Exactly is SMC Property Tax?

SMC property tax is a financial obligation imposed on all properties within Surat’s city limits, serving as a significant revenue source for the municipal corporation. The funds collected through this tax are allocated to various essential public services, including:

- Infrastructure Upgrades: Enhancements to roads, bridges, and streetlights.

- Sanitation and Waste Management: Efficient garbage disposal and recycling processes.

- Public Health Services: Maintenance and operation of hospitals and clinics.

- Educational Facilities: Support for schools and libraries.

Who Should Pay SMC Property Tax?

The responsibility of paying SMC property tax generally falls on the registered property owner’s shoulders. This includes:

- Individual Homeowners: If your name is on the property deed, you are responsible for this tax.

- Business Entities: Organizations that own commercial properties within the city must comply with these tax obligations.

Exceptions may apply under specific circumstances, such as properties under lease agreements, where the owner and tenant might share tax responsibilities based on their legal agreement.

Post Your Property Free

Key Factors Influencing Your Property Tax

Your SMC property tax bill depends on several factors that reflect the perceived value of your property:

- Property Location: Areas with better amenities and infrastructure command higher taxes.

- Age of Construction: Newer properties are typically taxed higher than older ones due to less depreciation.

Type of Property: Different taxes apply to residential, commercial, and industrial properties.

- Usage: Taxes can vary depending on whether the property is owner-occupied, rented, or used for business purposes.

Calculating Your SMC Property Tax

To give you an idea of how your property tax is calculated, consider this example (note: actual calculations may vary):

Example Calculation

- Built-up Area: 1000 square meters

- Rate per Square Meter: ₹10

- Base Tax: ₹500

Using the formula:

Estimated Property Tax=(Built-up Area×Rate per Square Meter)+Base TaxEstimated Property Tax=(Built-up Area×Rate per Square Meter)+Base Tax

The calculation would be:

Estimated Property Tax=(1000×10)+500=₹10500Estimated Property Tax=(1000×10)+500=₹10500

Convenient Payment Options

SMC offers multiple convenient methods for property tax payment:

Online Payment

- SMC ePay Service: Access this service through the SMC website to pay via credit/debit cards, internet banking, or potentially mobile wallets.

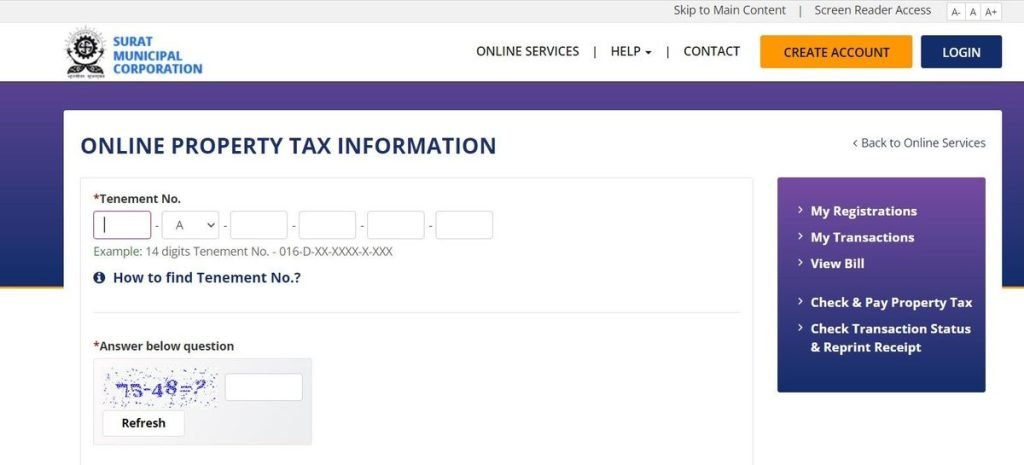

Steps to Make an Online Payment

- Go to the SMC ePay section on the municipal website.

- Select “Check & Pay Property Tax” from the menu.

- Enter your Tenement Number to pull up your tax details.

- Select a payment method and complete the transaction.

- Optionally, download or receive an email confirmation of your payment.

Offline Payment

- Bank Branches: Visit any designated bank that partners with SMC.

- Citizen Facilitation Centers (CFCs): Make payments directly at these centers using cash or check.

Exemptions and Rebates on SMC Property Tax

SMC offers several tax relief options to encourage timely payments and provide support to eligible groups:

- Exemptions for Specific Uses: Properties used exclusively for cemeteries or cremation services are exempt.

- Rebates for Early Payment: A 10% rebate for payments made in April and a 7% rebate for payments in May.

- Senior Citizen Rebate: A 10% discount on the general tax portion for senior citizens.

Benefits of Timely SMC Property Tax Payments

Paying your property tax not only keeps you compliant but also contributes to the community by funding local services that enhance the quality of life in Surat. Benefits include avoiding late fees, qualifying for rebates, establishing proof of ownership, and maintaining eligibility for loans.

By understanding and fulfilling your SMC property tax obligations, you play an integral part in supporting and sustaining the civic amenities and services that make Surat a vibrant and thriving city.

Frequently Asked Questions (FAQ’s)

Ans: SMC Property Tax is a levy imposed by the Surat Municipal Corporation on all properties within Surat city limits. The revenue collected from this tax is used to fund essential public services such as infrastructure, education, public health, and sanitation.

Ans: SMC Property Tax is calculated based on the built-up area, the location, the type of property, and its usage. The tax rate per square meter and any base tax applicable are also considered in the calculation.

Latest Blogs

- TDS Rates (20% vs 1%) on Property Sale by NRI: 2026 Guide

- BREAKING: No TAN Required for Buying Property from NRI (Budget 2026 Update)

- RBI Cuts Repo Rate to 6%: How It Affects You & the Economy