If you are buying an open plot in Hyderabad—whether it’s a premium HMDA plot in Mokila or a DTCP layout in Shadnagar—you have likely narrowed your loan options down to two giants: SBI (State Bank of India) and HDFC Bank.

Both are excellent, but they are very different.

In this detailed comparison, we analyze SBI vs HDFC plot loan based on interest rates, eligibility, loan tenure, approval conditions, and overall suitability for buyers in Telangana.

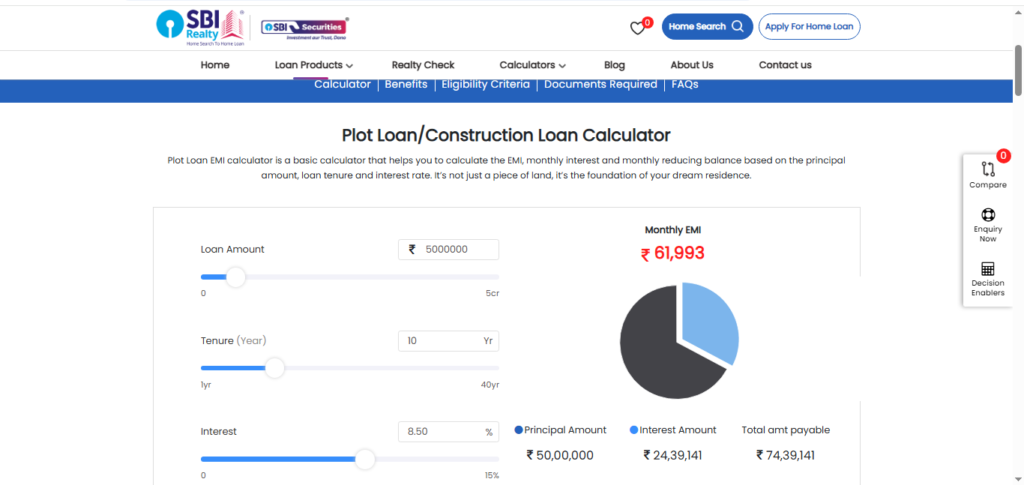

SBI Plot Loan in Telangana – Key Features

SBI is one of the most preferred banks for plot loans due to its competitive interest rates and transparent processing.

🔹 Interest Rate (Indicative 2026)

Starts from around 8.80% onwards (subject to CIBIL and profile).

🔹 Loan-to-Value (LTV)

Up to 60–70% of the plot value.

🔹 Maximum Tenure

Typically up to 10 years.

🔹 Processing Fee

Usually around 0.50% of loan amount (subject to revision).

🔹 Approval Conditions

- DTCP or HMDA approval mandatory

- Clear title documents

- Proper encumbrance certificate

- Residential classification

🔹 Best For:

- Salaried government employees

- Buyers looking for slightly lower interest rates

- Borrowers with strong credit profile

SBI is known for strict documentation and careful verification, which may slightly increase processing time but ensures security.

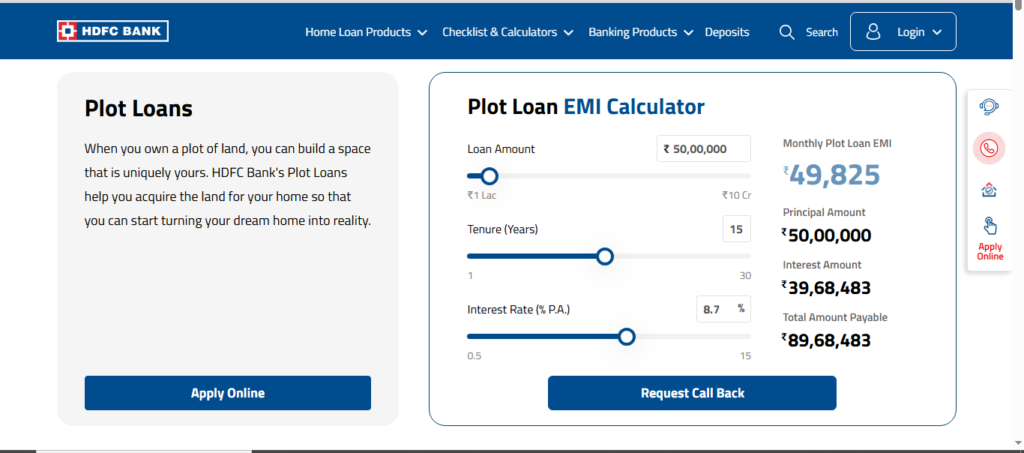

HDFC Plot Loan in Telangana – Key Features

HDFC is known for faster processing and flexible eligibility conditions, especially for salaried and self-employed applicants.

🔹 Interest Rate (Indicative 2026)

Starts from around 8.90% onwards.

🔹 Loan-to-Value (LTV)

Up to 60–70%, depending on location and applicant profile.

🔹 Maximum Tenure

Up to 15 years (higher than SBI in many cases).

🔹 Processing Fee

Up to 1% of loan amount.

🔹 Approval Conditions

- Approved residential layout (DTCP/HMDA)

- Clear legal documentation

- Stable income proof

🔹 Best For:

- Self-employed professionals

- Buyers seeking slightly longer tenure

- Applicants who prefer faster processing

HDFC may offer more flexibility in repayment structuring compared to SBI.

SBI Realty vs. HDFC Plot Loan (2026)

Here is the quick comparison sheet to help you decide.

| Feature | SBI Realty (Plot Loan) | HDFC Bank (Plot Loan) |

| Interest Rate (Feb 2026) | 8.50% – 9.15% (Lowest) | 8.70% – 9.40% |

| Max Loan Tenure | 10 Years | 15 Years (Better for EMI) |

| Processing Fee | Low (0.35%, Max ₹10k) | Higher (₹3,000 to ₹5,000 + GST) |

| Loan to Value (LTV) | Max 70-75% of Plot Value | Max 75-80% of Plot Value |

| Processing Time | Slow (20 – 30 Days) | Fast (7 – 10 Days) |

| Pre-Payment Charges | Nil | Nil (For Individuals) |

Deep Dive: The Case for SBI Realty

SBI is the most trusted bank in India. If you have time and perfect documents, SBI is unbeatable.

The Pros (Why Choose SBI?)

- Lowest Interest Rates: SBI almost always offers 0.20% to 0.50% lower rates than private banks. Over a 10-year tenure, this saves you lakhs.

- No Hidden Charges: Their processing fee is transparent, and there are no “admin fees” or “legal incidental charges” that private banks sometimes add.

- Legal Safety: If SBI approves your plot loan, it guarantees that the property documents are 100% clean. Their legal verification is the toughest in the industry.

The Cons (The “Deal Breakers”)

- The “5-Year Construction” Rule: This is the biggest catch. SBI requires you to construct a house on the plot within 5 years of taking the loan. If you don’t, they may convert the loan to a “Commercial Rate” (higher interest).

- Strict Eligibility: They rarely fund Gram Panchayat layouts unless they are perfectly regularized (LRS).

- Low Tenure: The maximum tenure is only 10 years. This means your monthly EMI will be higher compared to HDFC.

Read More: Complete Guide to Plot Loans in Hyderabad: Documents & Eligibility

Deep Dive: The Case for HDFC Bank

HDFC (Housing Development Finance Corporation) is a favorite for real estate investors who want speed and flexibility.

The Pros (Why Choose HDFC?)

- Higher Tenure (15 Years): HDFC offers plot loans for up to 15 years. This reduces your monthly EMI burden, making it easier to qualify for a bigger loan.

- Higher Funding: While SBI might stick to 70% of the government value, HDFC often funds up to 75-80% of the market value (depending on the profile), requiring less down payment from you.

- Doorstep Service: You don’t need to visit the branch 10 times. Their executives come to your home/office to collect documents.

The Cons (The “Deal Breakers”)

- Linked to RPLR: HDFC loans are linked to their Retail Prime Lending Rate (RPLR). Historically, private banks are slightly slower to pass on rate cuts compared to SBI.+1

- Strict CIBIL Requirement: If your CIBIL score is below 720, HDFC might reject the application or charge a very high interest rate.

Which One Should You Choose?

Choose SBI If:

- You are buying a plot strictly to build a house in the next 3-5 years.

- You want to save every penny on interest.

- You are in no rush and can wait 3-4 weeks for approval.

- Ideal Profile: Salaried Govt Employee or Corporate Employee with 750+ CIBIL.

Choose HDFC If:

- You are buying the plot as a long-term investment and might not build immediately. (HDFC is less strict about the construction clause).

- You need lower EMIs (15-year tenure).

- You need the loan approved urgently (within 1 week) to close the deal.

- Ideal Profile: Self-Employed, Business Owners, or NRIs.

Final Verdict

For Open Plots in Telangana, my recommendation is:

- First Choice: Apply to SBI first. Let them do the legal verification. If they approve it, take it. It confirms your property is safe.

- Second Choice: If SBI rejects it due to “income eligibility” or takes too long, move to HDFC.

Have you applied for a loan with SBI or HDFC recently? Share your experience in the comments below!

Frequently Asked Questions (FAQs)

Both SBI and HDFC offer competitive plot loan options in Telangana. SBI usually provides slightly lower interest rates, while HDFC offers longer tenure and flexible eligibility. The better option depends on your income profile and repayment capacity.

In 2026, SBI plot loan interest rates generally start from around 8.80%, while HDFC plot loan rates start from approximately 8.90%. Exact rates vary based on CIBIL score and loan profile.

SBI typically offers tenure up to 10 years, while HDFC may offer up to 15 years for eligible applicants. Longer tenure reduces EMI but increases total interest payable.

No. Most banks finance only 50% to 70% of the plot value. Buyers must arrange the remaining amount as down payment.

Yes. Banks usually approve loans only for DTCP or HMDA-approved residential layouts. Agricultural land or unapproved plots are generally not eligible.

Plot loan alone does not qualify for tax deductions. However, tax benefits under Section 80C and Section 24(b) may apply after construction of a residential house.