Are You Want to Know More Information on the Real Estate Vs Stock Market? Then, you must read this blog post. Let’s get into detail about the latest blog post –Real Estate Vs Stock Market – Which one do you choose?

1. Profits of Investing in Real Estate

Tangible Assets: Real estate investments provide tangible assets that you can see and touch. Owning physical properties can offer a sense of security and stability.

Cash Flow: Real estate can generate ongoing cash flow through rental income. Well-managed properties can provide a steady stream of income, which can help cover expenses and potentially yield a profit.

Appreciation Potential: Over time, real estate properties can appreciate in value. Market trends, location desirability, and property improvements can contribute to the appreciation of your investment.

Control and Value-Add Opportunities: Investing in real estate allows you to have control over your investment. You can make decisions regarding property management, renovations, and improvements that can increase its value and generate higher returns.

Diversification: Real estate can offer diversification in your investment portfolio. By owning properties in different locations and property types, you can spread risk and reduce the impact of market fluctuations.

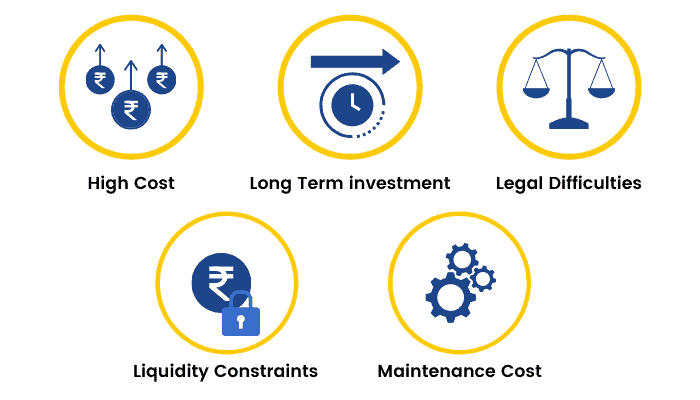

2. Cons of Investing in Real Estate

High Initial Costs: Compared to the stock market, investing in real estate often requires a substantial upfront investment. Property purchases involve costs such as down payments, closing costs, property inspections, and potential renovations.

Illiquidity: Real estate investments are relatively illiquid compared to stocks. Selling a property can take time, and the process can be more complex and costly. It may limit your ability to access funds quickly if needed.

Market Fluctuations and Risk: Real estate markets can be subject to cyclical fluctuations. Economic downturns or changes in local market conditions can impact property values and rental demand. Real estate investments come with the risk of property damage, unexpected repairs, or problematic tenants.

Property Management: Owning real estate requires active involvement in property management. It entails responsibilities such as finding tenants, addressing maintenance issues, and ensuring legal compliance. Managing properties can be time-consuming and may require hiring professionals or property management companies.

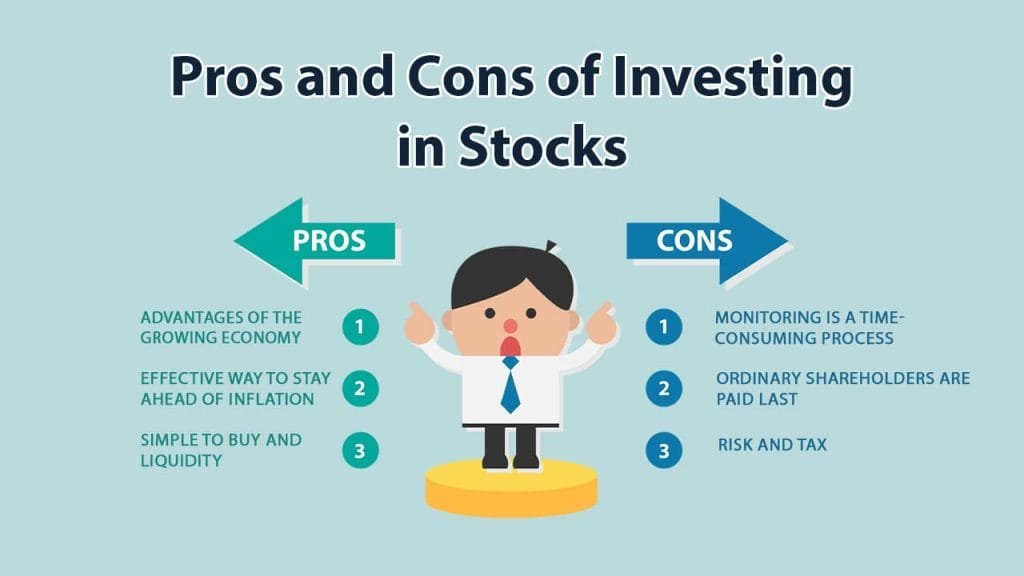

3. Profits of Investing in the Stock Market

Liquidity and Accessibility: The stock market offers high liquidity, allowing investors to buy and sell shares easily. It provides accessibility to a wide range of stocks, allowing you to diversify your portfolio with relative ease.

Potential for High Returns: Historically, the stock market has provided the potential for high long-term returns. Well-performing stocks can generate significant capital appreciation, especially when invested in growing companies or industries.

Dividend Income: Many stocks pay regular dividends, which are a portion of the company and profits are distributed to shareholders. Dividends can provide a steady income stream or be reinvested to purchase additional shares.

Diversification: The stock market allows for diversification across various industries, sectors, and geographic regions. Investing in different stocks helps spread risk and reduces the impact of individual company performance.

4. Cons of Investing in the Stock Market

Market Volatility: Stock prices can be highly volatile, influenced by factors such as economic conditions, company performance, industry trends, and geopolitical events. Short-term market fluctuations can result in significant losses if not carefully managed.

Lack of Control: As a stock investor, you have little control over the day-to-day operations of the companies you invest in. Corporate decisions, management changes, or market conditions can impact stock values, often beyond your control.

Emotional Factors and Investor Behavior: The stock market can evoke emotional responses, leading to impulsive investment decisions. Fear and greed can cause investors to buy or sell stocks based on short-term market movements, potentially undermining long-term investment strategies.

Information Overload: Staying well-informed and making accurate investment decisions can be challenging in the stock market due to the vast amount of information that influences it. Keeping up with market news, company financials, and economic indicators requires time and research.

Conclusion:

Investors can use both real estate and the stock market as viable strategies for growing wealth, but each option has its own pros and cons. Real estate offers tangible assets, cash flow, and control over property value-add opportunities. The stock market provides liquidity, potential high returns, and diversification options.

Also, Read Our Latest Blog Posts:

- The New Evolution of Telangana Secretariat and The Tallest Ambedkar Statue: Symbol of Equality and Justice

- A Wonderful Drive Trip On Outer Ring Road, Hyderabad

- Brief Info of Regional Ring Road, Hyderabad

- Exploring Hyderabad’s Mobility Valley: The Hub of Innovation and Connectivity

- Do You Know 13 Myths About HMDA Master Plan?

- Why Must Visit 15 Places in Hyderabad?

- Do You Know-BEST 10 PLACES TO VISIT IN WARANGAL

- Gold vs Real Estate: Which Is The Better & Smart Investment?

- Which House Facing Direction is Better to Live?

Frequently Asked Questions

A: Real estate investments provide tangible assets you can see and touch.

A: Corporate decisions, management changes, or market conditions can impact stock values in ways beyond an investor’s control.

A: One con of investing in the stock market is market volatility. Stock prices can be highly volatile, influenced by factors such as economic conditions, company performance, industry trends, and geopolitical events.