Property tax is a critical source of revenue for the local government in Faridabad, aiding in funding essential public services such as education, law enforcement, and infrastructure. This tax is imposed on property owners based on the assessed value of their property. The municipal corporation of Faridabad is responsible for collecting property taxes, which vary based on the property’s location, type, and assessed value.

How Property Tax is Calculated In Faridabad

the property tax formula is comprehensive, considering several factors to determine the due amount. The calculation involves the built-up area, age factor, base value, type of building, usage category, and the number of floors. Here’s a breakdown of these components:

- Built-up Area: This includes all covered spaces of the property, determining the size and extent of the taxable area.

- Age Factor: Properties are taxed differently depending on their age, with newer properties potentially incurring a higher tax.

- Base Value: This is an assessment of the property’s market value, considering its size, condition, and improvements.

- Type of Building: Residential properties may have different tax rates compared to commercial buildings.

- Category of Use: The purpose for which the property is used also affects the tax rate.

- Floor Factor: Properties with more floors may face higher taxes due to increased usage space.

Understanding these factors can help property owners estimate their tax obligations accurately.

How to Pay Property Tax in Faridabad

Paying property tax in Faridabad can be done both online and offline, providing flexibility and convenience to taxpayers.

Online Payment:

- Visit the Municipal Corporation of Faridabad’s official website.

- Go to the section where you can pay property taxes.

- Log in or register a new account.

- Enter the required property details like the tax assessment number.

- Verify the tax amount and proceed to payment options.

- Choose a payment method and complete the transaction.

- Obtain a receipt for record-keeping.

Offline Payment Options:

- By Mail: Send a check or money order to the local property tax office.

- In-Person: Visit the property tax office to pay by cash, check, or card.

- Drop-off Box: Utilize drop-off facilities if available.

- Bank Services: Some banks offer the facility to pay property taxes directly through an account.

- Third-Party Services: These platforms can facilitate payment via online methods or phone, though they might charge a service fee.

Post Your Property Free

Key Dates and Deadlines

Property taxes in Faridabad are payable in two installments, with deadlines on April 30th and October 30th each year. However, property owners are encouraged to pay their taxes by July 31st to take advantage of a 5% rebate offered by the Municipal Corporation of Faridabad. Late payments attract an interest charge of 1.5% per month.

Tax Exemptions and Rebates in Faridabad

Certain properties are exempt from paying property tax under Haryana Government regulations, including:

- Agricultural lands

- Properties owned by government entities

- Buildings used for educational or charitable purposes

- Properties owned by handicapped corporation officers or employees

- Land used for public worship or burial grounds

- Properties owned by recognized political parties

Conclusion

Property tax in Faridabad is a structured obligation that supports the city’s development and maintenance. Understanding its calculation, payment methods, and due dates can significantly ease the process for property owners. By staying informed and proactive, taxpayers can ensure compliance and avoid penalties, contributing positively to their community’s growth and well-being.

Frequently Asked Questions (FAQ’s)

Ans: Property tax is a local tax the municipal authorities impose on property owners. It is based on the property’s assessed value and contributes to funding various public services within the locality, such as schools, police services, and infrastructure maintenance.

Ans: Late payment of property tax in Faridabad incurs an interest charge of 1.5% per month on the outstanding amount until the tax is fully paid.

Latest Blogs

- Is Shadnagar Safe for NRI Investment? The 2026 Growth & Legal Report

- Plots vs. Flats: The “5-Year Challenge” – Who Won the Jackpot? (NRI Case Study)

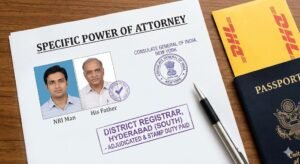

- Power of Attorney (GPA) Format for NRIs Buying Property in Hyderabad (2026 Guide)