The Pimpri-Chinchwad Municipal Corporation (PCMC), renowned as one of the wealthiest municipal bodies in India, significantly benefits from its multitude of multinational manufacturing companies. This economic boom has transformed the area into a bustling real estate market, attracting the workforce to invest in residential properties. Consequently, this surge in homeownership has necessitated the development of numerous housing societies and townships, supported by the robust infrastructure provided by PCMC. Property owners within this jurisdiction are required to pay their property taxes bi-annually, a process streamlined through digital advancements allowing for efficient online payments.

PCMC Property Tax Deadlines

Property tax payments in PCMC are structured in two installments. The first installment, covering April to September, must be paid by May 31st. The second installment, for the period from October to March, is due by December 31st. Adhering to these deadlines ensures property owners avoid any late fees or penalties.

Step-by-Step Guide to Online Payment

Paying your PCMC property tax online is straightforward. Here’s how you can do it:

- Navigate to the PCMC India portal.

- From the main menu, select ‘Resident’ then choose the ‘Property Tax’ option.

- Under the ‘Search property code’ section, input details such as zone number, group number, and property number.

- After retrieving your bill by clicking ‘Show’, proceed with the payment using your preferred online payment method.

Troubleshooting Payment Issues

Sometimes, you might face issues where the payment receipt isn’t instantly generated due to technical problems. If this occurs, it’s advised to check your bank account to confirm if the transaction was successful. Typically, it takes up to three working days for the receipt to appear on the website.

Utilizing Mobile Numbers for Property Searches

PCMC has simplified property searches by allowing property owners to use their registered mobile numbers. To use this feature:

- Visit the property tax section on the PCMC portal.

- Select ‘Search properties by phone number’.

- Enter the mobile number, receive an OTP, and proceed to access your property details.

Options for Online Payment Platforms

In addition to the official PCMC portal, property owners can use other platforms like Paytm for their transactions:

- Choose PCMC from the list of corporations on Paytm.

- Enter your property ID and other required details.

- Verify the tax amount and select your payment method.

- Complete the transaction to receive your e-receipt.

Viewing and Understanding Your Property Tax Bill

To view your property tax bill:

- Access the PCMC Property Tax portal.

- Navigate to ‘Property Bill’ and enter your zone number, Gat number, and owner’s name to search.

- Click on ‘Show’ to display your bill and review the total payable amount.

Benefits and Rebates on Property Tax

PCMC offers rebates for early payment and for properties that implement eco-friendly practices such as solar power, vermiculture, and rainwater harvesting:

- A 10% rebate on general tax is available for properties with an annual rateable value up to Rs 25,000.

- Properties exceeding this value receive a 5% discount.

- Additional rebates are available based on the number of eco-friendly installations.

Exemptions from PCMC Property Tax

Certain properties are exempt from tax, including those used for religious activities, public burials, cremations, heritage conservation, and charitable, educational, or agricultural purposes. Residential properties under 500 sq ft are also exempt, benefiting over 150,000 households.

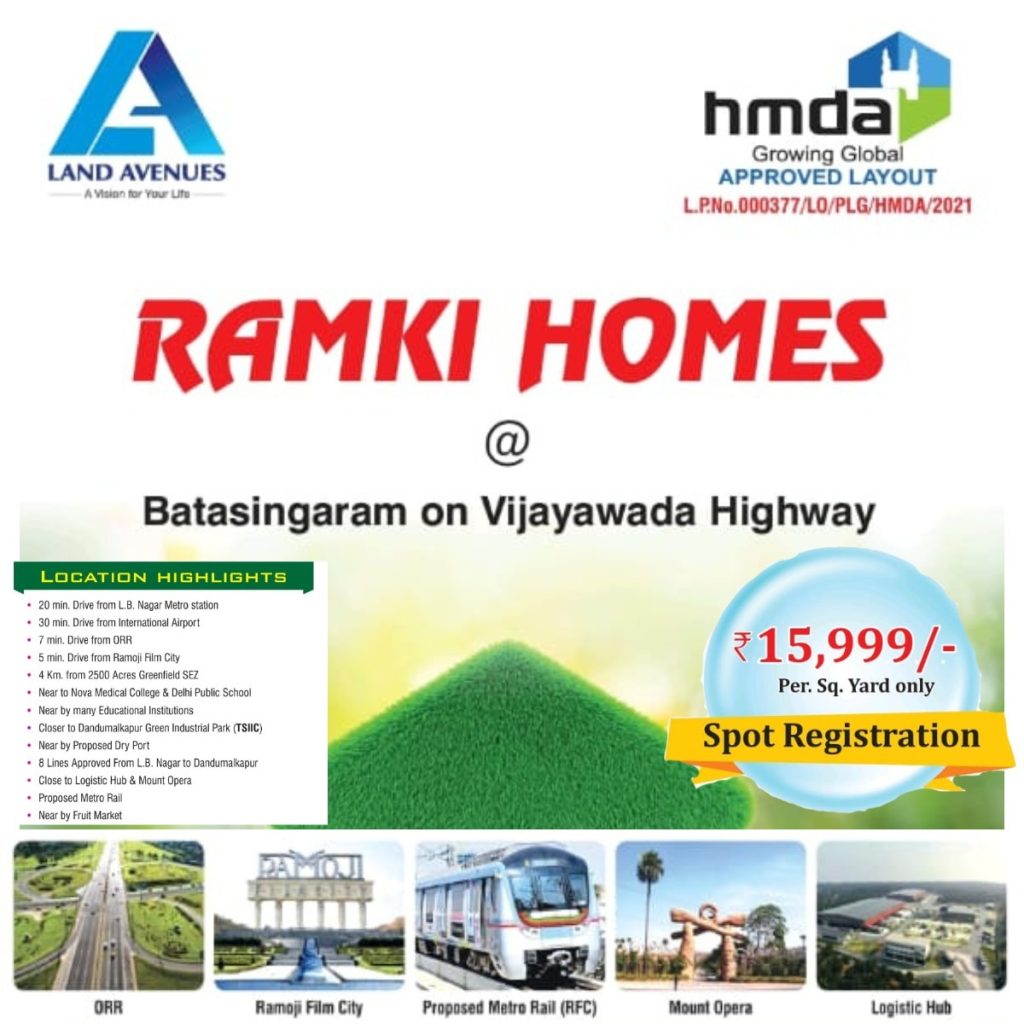

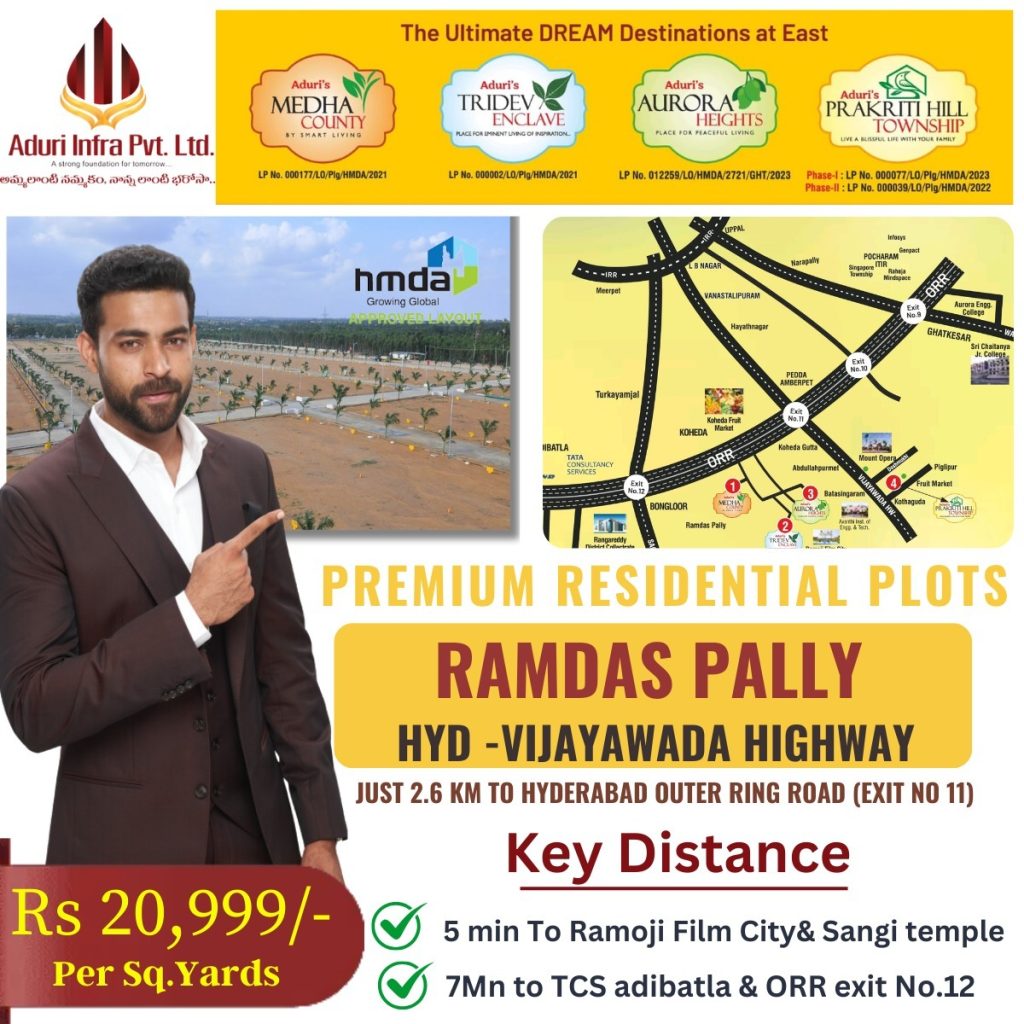

Open Plots Near Hyderabad

Filing Complaints and Contacting PCMC

For any issues or queries regarding property tax, residents can contact PCMC through:

- PCMC Sarathi Helpline Number: 8888 00 6666

- PCMC Sarathi website

Conclusion

Understanding and complying with your property tax obligations in PCMC is crucial for maintaining your property’s legal standing and contributing to the region’s development. By leveraging online platforms and adhering to the payment guidelines, residents can ensure a smooth and hassle-free experience.

Frequently Asked Questions (FAQ’s)

Ans: PCMC Property Tax is a local tax imposed by the Pimpri-Chinchwad Municipal Corporation on property owners within its jurisdiction. This tax is utilized to fund various municipal services and infrastructure projects in the area.

Ans: Property tax in the PCMC area is payable in two half-yearly installments. The first installment covers April to September and is due by May 31. The second installment covers October to March and is due by December 31.

Ans: Missing the payment deadline may result in penalties and interest charges. It is advisable to pay the tax before the due date to avoid extra charges.

Latest Blogs

- Vanguard Group Sets Up Global Capability Center (GCC) in Hyderabad

- How Will the Future City Development Authority (FCDA) Function?

- Hyderabad Future City: Telangana’s Vision for a Sustainable & Smart Metropolis