Property owners in Udhagamandalam or Ooty, whether residential, commercial, or industrial, have to pay Ooty property tax payment every year on the properties they own in the location. Property tax is collected by Udhagamandalam Municipality and can be paid online or offline through the official portal.

Check out this guide on how to collect property tax on time in Ooty. Ooty property tax: Factors based on The factors used to calculate property tax are:

- name of the municipality

- Title deed

- District

- place name

- ULB

- road name

- zone

- Total site area

- number of floors

- Architectural applications

- building type

- base area

- Type of resident

- Building age

- Annual Rental Value (ARV)

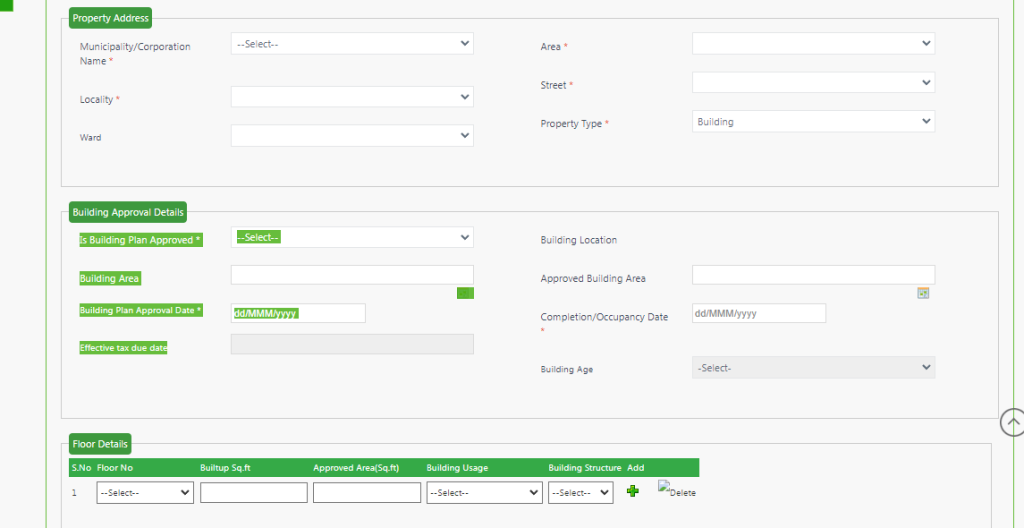

Ooty Property tax calculation:

Tamil Nadu Municipal Government Board provides a tax calculator tool to help you calculate Ooty property tax. It can be accessed from.

https://tnurbanepay.tn.gov.in/TaxCalculator.aspx

Enter all the required details like Municipality, Area, locality, building plan approval, No. of floors and all other details

Ooty property tax Assessment number

The assessment number is a unique property number assigned to your property. This number gives you all the information about your property and can also be used to pay property tax. The tax assessment number can be found on your property tax bill. If you have forgotten your tax assessment number, you can also log on to the Ooty Property Tax website to check your tax assessment number.

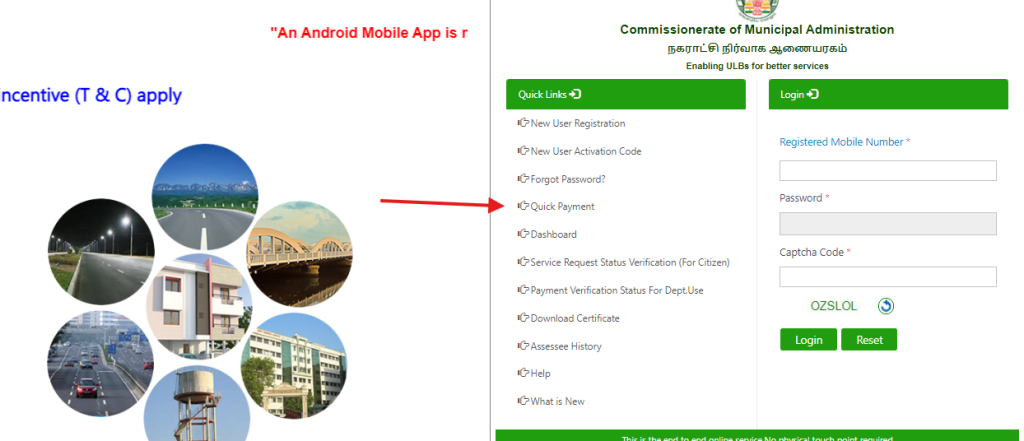

Ooty property tax payment online:

To pay Ooty property tax, visit the official website https://www.tnurbantree.tn.gov.in/uthagamandalam/, at the bottom of the page you can see the option ePay

you will be redirected to a new page where you can see the option quick payment

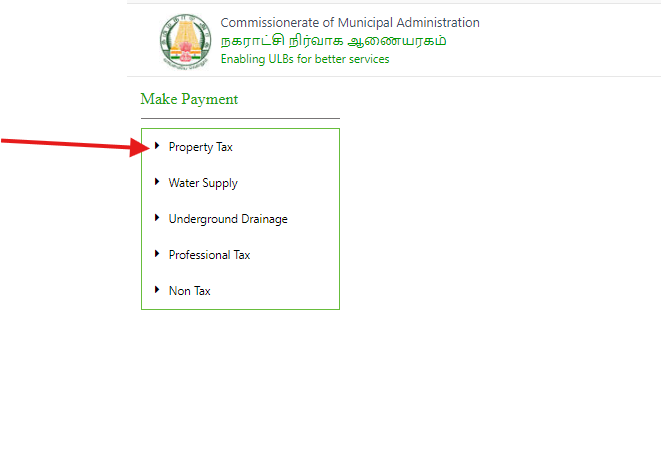

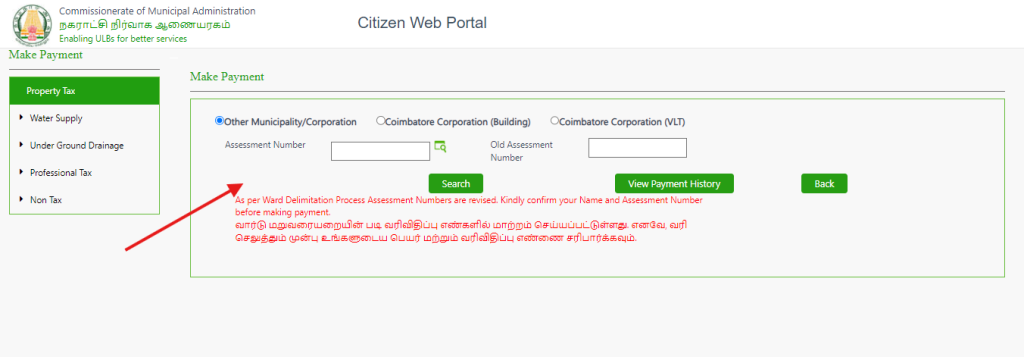

click on the quick payment option, you can see some services listed. click on Property tax

and enter your assessment number and click on search, you will get your property bill details and make the payment

to check payment history, click on view payment history and view the previous payment bills

Frequently Asked Questions:

The tax amount is determined by several factors, including:

Property location (municipality, zone, etc.)

Size of the property (total site area, number of floors)

Type of property (building type, base area)

Age of the building

Annual Rental Value (ARV)

The Tamil Nadu Municipal Government Board offers a tax calculator tool at https://tnurbanepay.tn.gov.in/TaxCalculator.aspx. Enter details like your municipality, area, building plan approval, etc., to estimate your tax amount.

All property owners in Udhagamandalam (Ooty), including residential, commercial, and industrial properties, are required to pay property tax annually.

Suggested Articles:

Allahabad/Prayagraj property tax payment, bills, and application status

AP Property tax payment Online & Property details and application status

NMMC Property Tax 2024: How to Pay Navi Mumbai Property Tax

BMC Property Tax 2024: How to Pay Brihanmumbai Municipal Tax