NRI Property Investment Guide

NRI Property Investment Guide : Investing in real estate is a significant decision, and for Non-Resident Indians (NRIs), the process involves navigating through a complex web of legalities. Purchasing property in India can be a rewarding endeavor, but understanding the legal framework is crucial to ensure a smooth and secure transaction. In this guide, we’ll walk you through the key legal considerations for NRIs looking to buy property in India.

Understanding the Basics

1. NRI Status and Eligibility:

Before delving into the legal aspects, it’s essential to establish your NRI status. NRIs are individuals who reside outside India for a specified duration, and Person of Indian Origin (PIO) and Overseas Citizen of India (OCI) status may also influence property ownership eligibility.

2. Types of Properties NRIs Can Buy:

NRIs are generally permitted to buy both residential and commercial properties in India. However, certain restrictions may apply, particularly concerning agricultural land and plantation property. Understanding these limitations is vital for making informed investment decisions.

Legal Documentation and Procedures

3. Know Your Rights:

NRIs enjoy the same property ownership rights as resident Indians. However, it’s crucial to be aware of any changes in regulations and ensure that the property is eligible for ownership by NRIs.

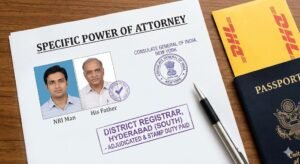

4. Power of Attorney (PoA):

Given the geographical distance, NRIs often rely on a Power of Attorney to facilitate property transactions. This legal document allows a trusted individual in India to act on the NRI’s behalf, streamlining processes such as property registration and banking transactions.

5. Tax Implications:

Understanding the tax implications of property ownership is paramount. NRIs need to be aware of taxes on rental income, capital gains, and repatriation. Seeking advice from tax professionals can help optimize your financial strategy.

Due Diligence and Property Verification

6. Title Deed Verification:

Before finalizing any property transaction, NRIs should conduct a thorough title deed verification. Ensuring that the seller has clear and marketable title to the property prevents legal complications in the future.

7. Legal Opinion:

Engaging a local lawyer to provide a legal opinion on the property is a prudent step. This ensures that all documentation is in order and that the transaction complies with Indian laws.

8. Property Registration:

Property registration is a critical step in the buying process. NRIs should be aware of the required documents and fees involved in registering the property in their name.

Remittances and Financial Transactions

9. Repatriation of Funds:

NRIs must understand the guidelines for repatriating funds. The Reserve Bank of India (RBI) has specific rules regarding the repatriation of sale proceeds, rental income, and other financial transactions.

10. Compliance with FEMA Regulations:

Adherence to the Foreign Exchange Management Act (FEMA) regulations is crucial. NRIs must stay informed about any changes in FEMA guidelines related to property transactions.

Conclusion: A Secure Investment Journey

NRI Property Investment Guide

Investing in real estate as an NRI involves meticulous planning and a thorough understanding of the legal landscape. By navigating through the legalities with care, NRIs can ensure a secure and transparent property transaction in India. Seeking guidance from legal professionals, staying informed about regulatory changes, and conducting due diligence are key steps in making the investment journey both rewarding and legally sound.

In the realm of NRI real estate investment, knowledge is power. As you embark on this journey, let this guide serve as a valuable resource, empowering you to make informed decisions and navigate the legalities of buying property in India with confidence.

People Also Read

- Is Shadnagar Safe for NRI Investment? The 2026 Growth & Legal Report

- Plots vs. Flats: The “5-Year Challenge” – Who Won the Jackpot? (NRI Case Study)

- Power of Attorney (GPA) Format for NRIs Buying Property in Hyderabad (2026 Guide)

A: The legal considerations for NRIs involve understanding their eligibility, types of properties they can buy, and the rights they enjoy, including changes in regulations that might impact ownership.

A: The Power of Attorney empowers a trusted individual in India to act on behalf of the NRI, facilitating processes such as property registration and banking transactions, especially crucial given the geographical distance.

A: NRIs need to consider taxes on rental income, capital gains, and repatriation. Seeking advice from tax professionals can help optimize their financial strategy.

A: Due diligence involves thorough title deed verification, legal opinions from local lawyers, and ensuring compliance with Indian laws. It helps prevent legal complications and ensures a transparent transaction.

A: NRIs can repatriate sale proceeds and rental income but must adhere to guidelines set by the Foreign Exchange Management Act (FEMA). Staying informed about these regulations is crucial for seamless fund repatriation.

A: Ensuring clear and marketable title deeds, engaging legal professionals for a legal opinion, and being aware of the required documents and fees are essential steps for a secure property registration process.

A: NRIs need to be aware of restrictions on investing in agricultural land or plantation property. Understanding these limitations is crucial for making informed investment decisions in these specific property types.