Mysore, a historical city in the southern state of Karnataka, India, is not just renowned for its palaces and vibrant cultural heritage but also for its progressive civic administration. The Mysore City Corporation (MCC) is at the helm of this administration, playing a crucial role in the city’s infrastructure and development. One key aspect of this is the property tax system. This article delves into the nuances of Mysore property tax, the role of MCC, the benefits of timely tax payment, the latest updates, and the broader real estate investment landscape in the city.

What is Property Tax?

Property tax is a mandatory charge imposed by the government on property owners. In Mysore, the MCC is responsible for assessing and collecting this tax. The revenue generated from property taxes is pivotal for the city’s development, funding various public services such as road maintenance, waste management, and public parks.

Role of Mysore City Corporation (MCC)

The Mysore City Corporation is the governing body responsible for the city’s municipal services and infrastructure. MCC’s responsibilities include:

- Assessment and Collection: MCC assesses properties based on their location, size, and usage (residential, commercial, or industrial). It then determines the tax amount.

- Infrastructure Development: The funds collected are utilized for improving the city’s infrastructure, including roads, sewage systems, and public amenities.

- Public Services: MCC ensures efficient delivery of essential services like water supply, garbage collection, and street lighting.

How to pay Mysore Property Tax

visit the official website https://mysurucitycorporation.co.in/

click on online services and select “Property details and pay online” option

you will get a new page to search for property details, select any one of the above

If you want to know the Property ID, enter your property ID and click on search. you will get the property details and make the payment

If you want to search with your details, select search by criteria option and enter the details to get your property details

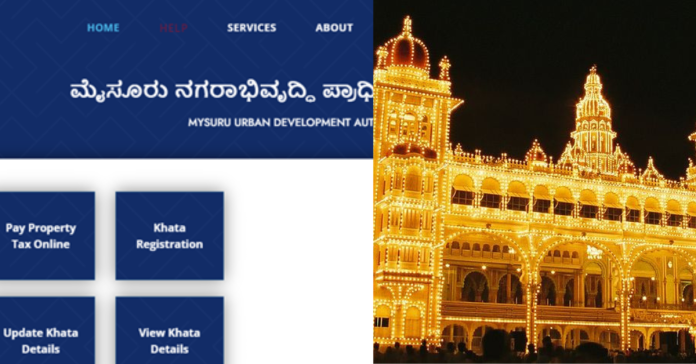

How to pay property tax payments in MUDA

MUDA: The Mysuru Urban Development Authority (MUDA) is a government body responsible for developing new layouts and allocating plots.

MUDA Property Tax: MUDA itself doesn’t typically levy a property tax. It may collect fees from property owners within its layouts, but this is not a standard property tax.

visit the official website https://mudamysuru.co.in/mudaportal/index.aspx

click on pay property tax online option

you need to enter your layout and site number , to get the details and verify details and make the payment

Other Services offered:

- Khata registration

- View Khata details

- Update Khata details

Who Qualifies for Property Tax Exemptions?

Several categories of properties and individuals are eligible for partial or full property tax exemptions in Mysore. These exemptions are typically granted to promote public welfare, support vulnerable populations, and encourage specific types of property usage. Here are the main categories:

- Charitable Organizations:

- Properties owned by registered charitable organizations that are used for charitable purposes are often exempt from property tax. This includes orphanages, old age homes, and facilities for the differently-abled.

- The primary condition is that these properties must be used exclusively for charitable activities without generating any profit.

- Educational Institutions:

- Government-run and government-aided educational institutions may receive property tax exemptions. This includes schools, colleges, and universities that provide education without a profit motive.

- Private educational institutions might also qualify if they are non-profit and serve public welfare.

- Religious Institutions:

- Properties used for religious worship such as temples, mosques, churches, and gurudwaras can be exempt from property tax.

- The exemption typically applies only to the portion of the property used directly for religious activities and not to commercial ventures run by these institutions.

- Government Properties:

- Properties owned by the central or state government and used for public purposes are generally exempt from property tax. This includes government offices, public hospitals, and other civic amenities.

- War Widows and Disabled Veterans:

- To honor and support war widows and disabled veterans, properties owned and occupied by them may be eligible for property tax exemptions.

- This concession is aimed at providing financial relief to those who have served the nation and their families.

- Low-Income Households:

- Properties owned by individuals or families falling below the poverty line might receive full or partial property tax exemptions.

- This measure is intended to alleviate the financial burden on economically weaker sections of society.

- Senior Citizens:

- In some cases, senior citizens who own and reside in their property may qualify for a property tax concession.

- The specifics of this exemption can vary and may depend on the income level and the age of the property owner.

How to Apply for Property Tax Exemption

To avail of property tax exemptions, eligible individuals or institutions must follow a specific procedure:

- Documentation: Submit necessary documents to prove eligibility. This can include registration certificates for charitable organizations, proof of government-aided status for educational institutions, and identity proof for war widows, veterans, or senior citizens.

- Application: Fill out the application form provided by the MCC, detailing the property and the reason for the exemption.

- Verification: MCC officials may conduct a verification process to ensure that the property and the applicant meet the exemption criteria.

- Approval: Once verified, the exemption will be granted, and the property owner will receive official documentation confirming the exemption status.

Benefits of Paying Property Tax

Paying property tax in Mysore offers several benefits:

- Legal Compliance: Regular payment of property tax ensures that the property is legally compliant, avoiding any legal issues with the MCC.

- Property Documentation: The tax receipt serves as a proof of ownership and can be crucial during property transactions.

- Civic Amenities: The revenue from property taxes is reinvested into the city’s infrastructure, enhancing the quality of life for residents.

- Public Services: Timely tax payments contribute to better public services and infrastructure, fostering a more livable city environment.

Latest Updates on Mysore Property Tax

The MCC has been proactive in implementing various measures to streamline property tax collection and make it more convenient for residents:

- Digital Payments: MCC has introduced an online payment system, allowing property owners to pay their taxes from the comfort of their homes. This digital initiative aims to increase transparency and reduce delays.

- Discounts and Rebates: To encourage timely payments, MCC offers discounts for early payment of property taxes. Typically, a rebate of 5-10% is offered for payments made before a stipulated date.

- Mobile App: MCC has launched a mobile application providing easy access to property tax details, payment options, and reminders for due dates.

Real Estate News and Investment Opportunities

Mysore’s real estate market is witnessing steady growth, driven by its cultural heritage, educational institutions, and burgeoning IT sector. Here’s a snapshot of the current real estate scenario:

- Residential Market: There is a growing demand for residential properties, particularly in well-planned localities like Vijayanagar, Gokulam, and Hebbal. The presence of reputed schools and healthcare facilities makes these areas attractive for families.

- Commercial Spaces: The IT boom has led to a rise in demand for commercial spaces. Tech parks and office complexes are increasingly coming up in areas like Hebbal Industrial Area.

- Affordable Housing: Government initiatives promoting affordable housing have spurred development in the outskirts of the city, making it possible for a broader demographic to invest in property.

- Investment Potential: Mysore offers a relatively lower cost of living and property prices compared to metropolitan cities, making it a lucrative option for investors looking for long-term gains.

Frequently Asked Questions:

Property tax is a mandatory charge imposed by the government on property owners to fund public services and infrastructure.

Timely payment of property tax ensures legal compliance, provides proof of ownership, enhances public services, and contributes to better civic amenities.

Property tax exemptions in Mysore are available to:

Charitable organizations

Educational institutions

Religious institutions

Government properties

War widows and disabled veterans

Low-income households

Senior citizens

The MCC has introduced digital payment systems, offers discounts for early payments, and launched a mobile app for easy access to property tax details and payment options.

To apply for an exemption, you need to submit the necessary documents, fill out an application form from the MCC, undergo a verification process, and obtain official approval.

Suggested Articles:

Vadodara Property tax payment, Property details & Download bills

Shimla Municipal Corporation – How to Pay Property Tax, Water Bill

Andhra Pradesh Property Tax 2024: How to Pay AP Property Tax