1. How to Calculate and Pay GHMC Property Tax Online?

Purchasing real estate entails legal duties that extend beyond signing. The

GHMC Property Tax in Telangana is essential for avoiding land

confiscation. Residents’ taxes are collected by the Greater Hyderabad Municipal

Corporation (GHMC). It is one of India’s largest municipal corporations,

servicing 7.9 million people across an area of 650 square kilometers.

2. What is the GHMC Property Tax?

The Greater Hyderabad Municipal Corporation (GHMC)

is in charge of collecting home and property taxes from the citizens of

Hyderabad. The amount of property tax paid by the people of this area

contributes significantly to the state government’s revenue. Municipal bodies

employ these levies to improve the city’s living standards by ensuring that

public amenities are effectively maintained.

The GHMC property tax is payable annually by both

residential and commercial property owners. You must pay an annual tax to the

state government if you own a residential property, whether you live in it or

rent it out. Similarly, properties utilized for business reasons must pay the

tax assessed against them.

The municipal corporation utilizes the total amount of taxes collected to fix

potholes, install street lights, construct parks and pathways, and focus on the

general development of the city’s infrastructure. It is also in charge of

rubbish collection and preserving the city’s cleanliness. The company is also

in charge of the Health and Sanitation department.

3. How Do You Calculate Hyderabad Property Tax?

- Step 1:

Make a note of the Plinth Area (PA). The Plinth size is the overall size

of the home, including all covered spaces such as storerooms, balconies,

and garages. - Step 2 –

If you utilise the property, find out the most current

rent-per-square-foot for other properties in your area’s real estate

market. Consider the rent-per-square-foot indicated in the rental

agreement that was prepared at the time of renting if the property is

rented to someone else. The ultimate number computed will be your Monthly

Rental Value (MRV) per square foot. - Next, Step 3 – Use the method below to calculate the precise amount of GHMC

property tax data by door number.

Annual Residential Property Tax = PA x MRV (per sq.ft.) x

12 x (0.17 – 0.30) depending on the monthly rental value in the table below –

10% depreciation + 8% library cess.

4. Follow the instructions below to calculate GHMC property taxes.

- Step 1: Determine the Plinth Area (PA).

- Step 2 – For commercial properties, you must check the Monthly Rental Value (MRV)

for the given monthly rent per square foot for various circles in various

taxation zones as provided in GHMC official announcements. Check the GHMC

Website and the Proposed Division of Zones

(https://www.ghmc.gov.in/proposed_div_zones.aspx) for any GHMC property

tax facts. - Last, Step 3 – Use the method below to calculate the precise amount of GHMC

property tax payment.

Annual Commercial Property Tax = 3.5 x PA in sq. Ft. x MRV in Rs. /sq. Ft.

Note –

- For commercial properties like as ATMs and cellular

towers/hoardings, the maximum monthly rent per square foot for taxes is

Rs.70 and Rs.50, respectively.

- For commercial establishments like as educational institutions

and hospitals, the minimum monthly rent per square foot is fixed at Rs.8

and Rs.9.50, respectively.

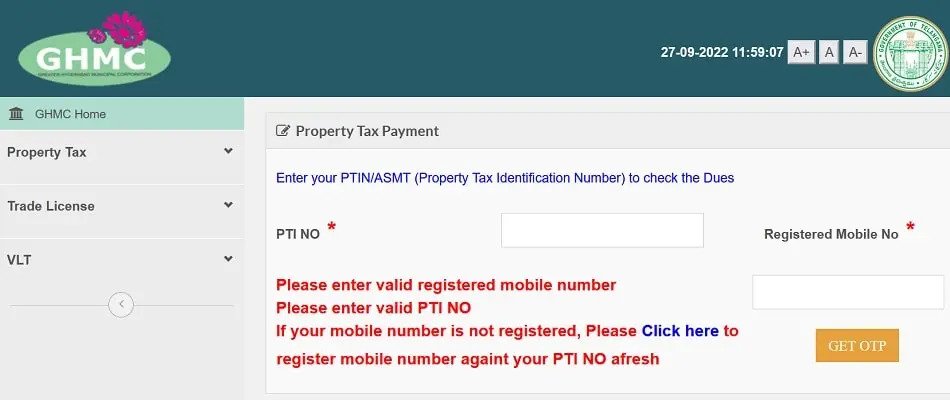

5. How to Pay the GHMC Property Tax Online?

- Sign in to the GHMC’s official website.

- Under the Online Payments section, select the ‘Property Tax’

option. - Fill in the PTIN to ‘Know Property Tax Dues’.

- You will now view all of your information, including arrears,

interest on arrears, property tax amount, and modifications. Check them. - Choose an online banking option to pay your GHMC property tax

dues. You can use a credit card, a debit card, or another type of online

banking. - Enter your PTIN to get the GHMC property tax receipt.

6. How Can I Pay My GHMC Property Tax Online?

You may pay your GHMC Hyderabad property tax in person at one of the following locations:

- There are 72 MeeSeva Centres within the GHMC area.

- All 19 circles have a Citizen Service Centre.

- Bill Collectors at GHMC

- Any State Bank of Hyderabad branch

Official papers required to pay property tax in Telangana using offline means –

- The property’s sale document.

- An occupancy certificate was obtained from the builder prior to

moving in. - copy of the architect’s design for the building.

- Cheque or demand draught made payable to the GHMC commissioner.

7. What are the current property tax rates in Hyderabad?

Current Slab Rate for Property Tax Hyderabad

Monthly Rental Value | General Tax | Conservancy Tax | Lighting Tax | Drainage Tax | Total |

Rs.0 – Rs.50 | Exempt | Exempt | Exempt | Exempt | Exempt |

Rs.51 – Rs.100 | 2.00% | 9.00% | 3.00% | 3.00% | 17.00% |

Rs.101 – Rs.200 | 4.00% | 9.00% | 3.00% | 3.00% | 19.00% |

Rs.201 – Rs.300 | 7.00% | 9.00% | 3.00% | 3.00% | 22.00% |

Rs.300 and above | 15.00% | 9.00% | 3.00% | 3.00% | 30.00% |

Age rebate on building

0-25 years | 10% |

26-40 years | 20% |

More than 40 years |

Penalty on Late Payment | Due Dates to Pay GHMC Property Tax

If the taxpayer is unable to pay the GHMC property tax by the due dates,

he/she will have to pay an additional amount of 2% per month on the outstanding

amount as the penal interest.

8. Greater Hyderabad Municipal Corporation Circles and Zones

Sl.No. | Circle No. | Circle Name | Zone Name |

1 | Circle-1 | Kapra | L.B. Nagar |

2 | Circle-2 | Uppal | L.B. Nagar |

3 | 3 rd Circle | Hayathnagar | “ |

4 | Circle-4 | L.B.Nagar Zone | L.B. Nagar |

5 | Circle-5 | SaroorNagar | L.B. Nagar |

6 | 6th Circle | Malakpet | Charminar |

7 | Circle-7 | Santoshnagar | Charminar |

8 | Circle-8 | Chandrayangutta | “ |

9 | 9-Circle | Charminar | Charminar |

10 | Circle-10 | Falaknuma | Charminar |

11 | Circle-11 | Rajendra Nagar | “ |

12 | 12-Circle | Mehdipatnam | Khairathabad |

13 | Circle-13 | Karwan | Khairathabad |

14 | Circle-14 | Goshamahal | “ |

15 | 15-Circle | Musheerabad | Secunderabad |

16 | Circle-16 | Amberpet | Secunderabad |

17 | Circle-17 | Khairatabad | Khairathabad |

18 | 18-Circle | Jubilee Hills | Khairathabad |

19 | Circle-19 | Yousufguda | Serilingampally |

20 | Circle-20 | Serilingampally | Serilingampally |

21 | 21-Circle | Chandanagar | “ |

22 | Circle-22 | RC Puram, Patancheruvu | Serilingampally |

23 | Circle-23 | Moosapet | Kukatpally |

24 | 24-Circle | Kukatpally | Kukatpally |

25 | Circle-25 | Qutbullapur | “ |

26 | Circle-26 | Gajularamaram | Kukatpally |

27 | 27-Circle | Alwal | “ |

28 | Circle-28 | Malkajgiri | Secunderabad |

29 | Circle-29 | Secunderabad | Secunderabad |

30 | 30-Circle | Begumpet | “ |

Also, Read Our Latest Blog Posts:

- The New Evolution of Telangana Secretariat and The Tallest Ambedkar Statue: Symbol of Equality and Justice

- A Wonderful Drive Trip On Outer Ring Road, Hyderabad

- Brief Info of Regional Ring Road, Hyderabad

- Exploring Hyderabad’s Mobility Valley: The Hub of Innovation and Connectivity

- Do You Know 13 Myths About HMDA Master Plan?

- Why Must Visit 15 Places in Hyderabad?

- Do You Know-BEST 10 PLACES TO VISIT IN WARANGAL

- Gold vs Real Estate: Which Is The Better & Smart Investment?

- Which House Facing Direction is Better to Live?

Frequently Asked Questions

Ans: GHMC Property Tax is a tax imposed by the Greater Hyderabad Municipal Corporation on residential and commercial properties within Hyderabad to fund public amenities and infrastructure development.

Ans: GHMC calculates the tax based on the property’s Plinth Area (PA) and Monthly Rental Value (MRV) per square foot.

Ans: Yes, you can pay your GHMC Property Tax online through the official GHMC website using various online payment methods.