The Greater Warangal Municipal Corporation (GWMC) website offers a convenient way for the residents of Warangal, Telangana, to pay their property taxes online. This platform eliminates the need for in-person visits, streamlining the tax payment process and enhancing transparency and accountability for both authorities and citizens. This article explains the services available on the GWMC website and provides a step-by-step guide to paying your property tax.

Features of the GWMC Property Tax Online Portal

The GWMC Portal is user-friendly and offers various features to simplify the tax payment process:

- Online Applications: Apply for licenses, assessments, and other services directly through the portal.

- Government Links: Access links to other important government websites, facilitating easier completion of related tasks.

- Tax Services: Pay various property-related taxes, including water tax, online.

- Downloads: Download property and house tax application forms and other related documents.

Functionalities of the GWMC Website

The GWMC website offers several useful functionalities for residents:

1. GWMC House Tax Enquiry

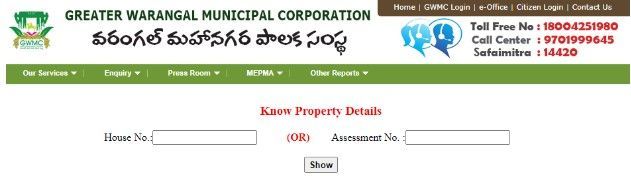

To inquire about outstanding tax dues, follow these steps:

- Visit the GWMC website, click on the “Enquiry” tab, and select “Tax Enquiry.”

- Enter your house number or assessment number on the next page.

- Click “Show” to view your tax dues.

2. GWMC Self-Assessment

Residents can self-assess their property taxes by:

- Clicking on the “Online Self-Assessment Application” tab on the homepage.

- Entering their mobile number to receive a One Time Password (OTP).

- Applying for the self-assessment of the tax.

Also Read: All About Warangal Airport(Mamnoor Airport):Latest News&Updates

3. Checking the Application Status

- Go to the GWMC website and scroll to the EDOB services.

- Select “Online Self-Assessment Application Status.”

- Click on “Search Application Status” Then enter your application number.

- View the status of your application.

4. Calculating the GWMC Property Tax

Calculate your property tax by:

- Selecting “Our Services” on the GWMC property tax website.

- Choose”Property Tax” and then select “Calculate Property Tax.”

- Entering the required details, such as house number and nature of construction.

- Click “Submit” to view the calculated tax amount.

5. Paying the GWMC Property Tax Online

To pay your property tax online:

- Open the GWMC website.

- Click on “Pay Property Tax.”

- Enter the necessary details, such as your house number.

- You will be redirected to a new page with your house details and a payment link.

- Verify the details and select a payment method (net banking, credit card, debit card, NEFT, etc.).

- Complete the payment process.

Conclusion

The GWMC property tax payment online system is an excellent initiative that ensures transparency and reduces hassle for the residents of Warangal. Regular payment of housing and property taxes is crucial for homeowners.

Latest Blogs

- Warangal-Mamnoor TG 2nd Airport Approved : Latest Updates

- GWMC Property Tax: How to Pay Property Tax in Warangal?

- Laknavaram Lake &Cable Bride: Timings, Location, Boating Fee