Owning property in Ghaziabad comes with the responsibility of paying the Ghaziabad Nagar Nigam House tax(Ghaziabad Municipal Corporation). This tax contributes to the city’s development and maintenance of essential services like sanitation, infrastructure, and public amenities. Here’s a comprehensive guide to Ghaziabad Nagar Nigam property tax, covering everything you need to know:

Understanding Property Tax:

- What is it: Property tax is an annual levy on the ownership of real estate (residential or commercial) within Ghaziabad.

- How is it calculated: The tax amount is usually determined by the property’s size, location, and type (residential/commercial). The new tax structure, implemented in April 2024, categorizes colonies under A, B, and C based on their value.

- Who needs to pay: If you own a property in Ghaziabad, you are liable to pay the Ghaziabad Nagar Nigam House tax.

Important Information:

- New Tax Structure: As of April 1, 2024, Ghaziabad Nagar Nigam implemented a new property tax structure based on colony categorization (A, B, C). This replaced the previous uniform rental value system.

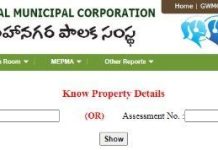

- Tax Assessment: The Ghaziabad Nagar Nigam assesses the property tax for each property owner. You can access your assessment details online through the Ghaziabad Nagar Nigam portal (https://onlinegnn.com/).

- Payment Methods: Ghaziabad Nagar Nigam House tax offers convenient online and offline payment options. You can pay online through the GNN portal or various banks’ online platforms. Offline options include designated bank branches and tax collection centers.

Benefits of Timely Payment:

- Rebates: The Ghaziabad Nagar Nigam often offers rebates for early payments (usually a specific percentage of the total tax amount).

- Avoid Penalties: Late payments accrue penalties, increasing your overall tax burden.

- Improved Services: Timely tax collection allows the Ghaziabad Nagar Nigam to invest in better infrastructure and services for the city.

How to Pay Ghaziabad Nagar Nigam House tax:

visit the official website https://onlinegnn.com. click on the Pay Property Tax option

Then You will get a new page, click on the pay tax online option. enter the details like zone or PIN no or name or House No etc.

You need to enter any one of the fields and enter the captcha, click on submit. you will get the property tax details below. click on pay tax and you can see the amount due on your property and check the details, click on the make payment option. Choose the payment gateway either HDFC cards or global payments. if you want to make the payment with phone pe or internet banking choose global payments as the payment method and complete the Ghaziabad Nagar Nigam House tax payment

How to get a property tax bill receipt

visit the official website https://onlinegnn.com. click on the pay property tax option. you will get a page and select the option receipts from the top menu

Enter your PIN no or Receipt number to check the paid bill amount.

Frequently Asked Questions:

It’s an annual tax you pay for owning property (residential or commercial) in Ghaziabad. This tax helps fund essential city services like sanitation and infrastructure.

The amount depends on your property’s size, location, and type (residential/commercial). A new system categorizes colonies (A, B, C) based on value, affecting the tax rate.

Ghaziabad Nagar Nigam offers convenient online and offline options. You can pay online through their portal or various banks’ platforms. Offline options include designated bank branches and tax collection centers.

Early payments often qualify for rebates, while late payments incur penalties. Timely tax collection helps the city invest in better services for everyone.

Suggested Articles:

Vadodara Property tax payment, Property details & Download bills

Udupi Property Tax 2024: How to pay Udupi City Municipal Tax

Property tax Faridabad 2024: How to pay tax online and offline?

Allahabad/Prayagraj property tax payment, bills, and application status