In the financial landscape, understanding capital gains tax is paramount for investors. Let’s delve into the intricacies of this tax regime and explore its implications for asset sales.

What Are Capital Gains Taxes?

A capital gains tax is a tax levied on the profits earned from the sale of an asset. This tax applies exclusively when an investment is sold, affecting a variety of capital assets including stocks, bonds, cryptocurrencies, NFTs, jewelry, coin collections, and real estate.

Long-Term vs. Short-Term Gains

i) Long-Term Gains

Long-term gains occur when assets are held for more than a year. These gains are subject to preferential tax rates, set at either 0%, 15%, or 20%, contingent upon the filer’s income.

II) Short-Term Gains

In contrast, short-term gains are taxed at the individual’s regular income tax rate, which is typically higher than the rate applied to long-term gains.

Deciphering Capital Gains Tax

When taxable investment assets, such as stock shares, are sold, the resulting profits are realized, triggering the capital gains tax. Notably, this tax is not applicable to unsold investments or unrealized gains.

Tax Rates for 2023 and 2024

Long-Term Capital Gains

The tax rates for long-term capital gains vary from 0% to 20%, depending on the taxpayer’s income bracket. These rates offer investors a significant advantage, incentivizing asset retention for extended periods.

Short-Term Capital Gains

On the other hand, short-term capital gains are taxed at the individual’s ordinary income tax rate, often surpassing the long-term gains rate.

Special Considerations

Collectibles

Short-term gains on collectibles are taxed as ordinary income, while long-term gains have a maximum tax rate of 28%.

Owner-Occupied Real Estate

Capital gains from the sale of a primary residence may qualify for exclusion from taxable income, provided certain criteria are met. However, capital losses from personal property sales are not deductible against gains.

Investment Real Estate

Investors in real estate can claim depreciation deductions, which may impact taxable capital gains upon property sale. Recaptured depreciation deductions are subject to a 25% tax rate.

Post Your Property Free

Additional Taxation

High-income individuals may be subject to the net investment income tax, imposing an additional 3.8% tax on investment income, including capital gains.

Navigating the complexities of capital gains tax calculation is crucial for investors seeking to optimize their financial strategies. Let’s explore the process and strategies to minimize tax obligations effectively.

Deducting Capital Losses

Capital losses can be subtracted from capital gains to determine taxable gains for the year. When dealing with both short-term and long-term investments, segregate gains and losses accordingly:

- Short-Term vs. Long-Term: Sort short-term gains and losses separately from long-term ones.

- Netting Gains and Losses: Total short-term gains and losses to ascertain net short-term gain or loss. Repeat the process for long-term gains and losses.

Most individuals utilize tax software for accurate computations. Alternatively, capital gains calculators provide estimates for potential or realized sales.

Strategies to Mitigate Capital Gains Taxes

Despite tax obligations on investment profits, various legitimate approaches can minimize capital gains taxes:

- Hold Investments Long-Term: Holding assets for over a year qualifies for lower long-term capital gains tax rates compared to short-term gains.

Leverage Capital Losses: Offset gains with losses, deducting up to $3,000 in excess losses annually. Unused losses can be carried forward into future years..

- Track Investment Expenses: Document qualifying expenses to increase the investment’s cost basis, thereby reducing taxable profit.

- Utilize Tax-Advantaged Accounts: Investing in 401(k)s or IRAs defers capital gains taxes until withdrawal, offering potential tax savings.

- Explore Exclusions: Understand rules allowing the exclusion of gains, such as selling a primary residence. Timing sales strategically can optimize exclusion benefits.

- Consider Retirement Timing: Selling assets post-retirement may reduce tax liabilities due to lower income levels.

- Monitor Holding Periods: Ensure assets are held over a year to qualify for favorable long-term capital gains tax treatment.

- Select Cost Basis Method: Evaluate different cost basis calculation methods to optimize tax outcomes, considering factors like purchase price and gain declaration.

The Impact of Capital Gains Taxes

Capital gains taxes, determined by factors like holding period and income level, influence investment returns. Proponents argue that lower rates incentivize saving and investment, stimulating economic growth.

Understanding capital gains tax intricacies empowers investors to make informed decisions, maximizing returns while minimizing tax liabilities. By implementing effective strategies and leveraging available exclusions, investors can confidently navigate the tax landscape and optimize their financial outcomes.

Latest Blogs

- Is Shadnagar Safe for NRI Investment? The 2026 Growth & Legal Report

- Plots vs. Flats: The “5-Year Challenge” – Who Won the Jackpot? (NRI Case Study)

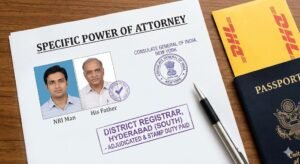

- Power of Attorney (GPA) Format for NRIs Buying Property in Hyderabad (2026 Guide)