Owning property in any country requires paying a tax known as property tax, which is calculated based on the value of the property. This tax is levied by the local government, which determines the rate. Property owners are responsible for paying this tax, which funds local infrastructure and civic amenities. In Andhra Pradesh, India, paying property tax is mandatory for both rural and urban properties, with the amount based on the property’s current market value. Late payments incur significant penalties.

Taxable Properties in Andhra Pradesh

Property tax in Andhra Pradesh applies to both residential and commercial properties. The tax amount is determined based on the property’s assessment. Residential properties with an Annual Rental Value (ARV) below Rs. 600 are exempt from property tax. Property owners must notify the Department of Town Planning about any construction, renovation, or improvement to ensure accurate tax assessment.

Components of Andhra Pradesh Property Tax

The Andhra Pradesh property tax consists of four main components, each serving a specific purpose:

- General Purpose Tax: Funds municipal operations and development projects.

- Water & Drainage Tax: Supports water distribution and sewage treatment.

- Lighting Tax: Maintains and improves street lighting.

- Scavenging Tax: Manages waste collection and disposal.

These components are crucial for maintaining and improving local infrastructure and services.

Property Tax Assessment

Property tax assessment in Andhra Pradesh involves several steps. A designated assessor evaluates the property based on various factors, including location, size, type, and use. A record book is created, containing details such as the owner’s name, property address, and tax amount. This information ensures transparency and accuracy in tax calculation.

Calculating Property Tax

The process of calculating property tax in Andhra Pradesh includes:

- Annual Rental Value (ARV): Estimates the yearly rental revenue if the property is leased. ARV depends on the property’s size, location, type, amenities, and market conditions.

- Property Categorization: Properties are classified as residential, commercial, industrial, or vacant. Tax rates vary by category.

- Tax Rate: Applied based on the ARV and property category.

- Additional Taxes: Include lighting, water, and scavenging taxes.

Deductions, Exemptions, and Rebates

Certain properties are eligible for tax deductions or exemptions, such as those used for religious purposes, government-owned properties, or senior citizens’ residences.

Open Plots Near Hyderabad

Online Property Tax Payment

Paying property tax in Andhra Pradesh can be done online via the official CDMA website. The steps include:

- Visit the CDMA website.

- Navigate to the property tax payment section.

- Select the district and municipality.

- Enter property details and proceed to the payment section.

- Make the payment using online banking or a credit/debit card.

- Receive an acknowledgment receipt upon successful payment.

Also Read: Ap Tourism-26 Best Tourist Places Visit in Ap

Additional Services on the CDMA Portal

The CDMA portal offers additional services such as vacancy remission, demolition filing, tax exemption applications, and document downloads.

Offline Payment Method

Property owners can also pay their taxes offline by visiting municipal offices or PuraSeva centers, where they can interact directly with property tax officials.

Rebates on Property Taxes

Rebates are available for early payments and self-occupied residential buildings. Discounts vary based on the property’s age.

Penalty for Non-Payment

Property tax is collected semi-annually in Andhra Pradesh. An interest of 2% per month is charged on overdue amounts, with additional penalties for illegal constructions.

Conclusion

Paying property tax is a civic duty that supports the local government in providing essential services and maintaining infrastructure. By understanding the payment methods, exemptions, and deadlines, property owners in Andhra Pradesh can contribute to their community’s development and ensure compliance with tax regulations.

Latest Blogs

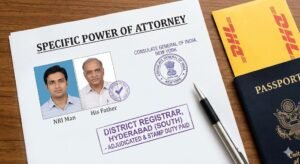

- Power of Attorney (GPA) Format for NRIs Buying Property in Hyderabad (2026 Guide)

- TDS Rates (20% vs 1%) on Property Sale by NRI: 2026 Guide

- Best Way to Send Money to India for Property Purchase (2026 Guide)