Are You Want to Know More Information on the UAN Portal Login? Then, you must read this blog post. Let’s get into detail about the latest blog post – A Step-by-Step Guide on UAN Login and EPFO.

1. How Do You Get a UAN Number?

Whenever an employee makes a contribution to the Employees Provident Fund, they are given a 12-digit number known as a UAN. The Employee Provident Fund Organization (EPFO) is responsible for creating and allocating this special number. The Ministry of Labor and Employment authenticates UAN in accordance with directives from the Indian government.

Regardless of how many times an individual has changed jobs, this number stays the same for them throughout their career.

In order to use this UAN more effectively, people must not only understand what a UAN number is but also various associated topics.

2. The value of UAN

- The term “Universal Account Number” is its entire form.

- UAN is significant for a number of reasons. These include

- The unique UAN does not change until an employee retires.

- To examine the credits and debits in the PF account, UAN is necessary.

- Individuals can withdraw and transfer money using UAN without depending on their employer.

- Thanks to online processing, employees have unrestricted access to their PF accounts.

- Employees can monitor monthly deposits with UAN. However, the exact employee must be noted on the EPFO.

- The section indicated above clearly demonstrates the purpose and necessity of a Universal Account Number (UAN). Let’s now concentrate on the many benefits that its uses offer.

3. Benefits of UAN

Some of the benefits of UAN numbers are covered below. Follow along!

i) Effortless Transfer of Funds

- Previously, transferring money manually from old PF accounts to new ones took a lot of effort and was prone to mistakes. Even the use of a digital method did not considerably simplify this process.

- However, following the deployment of UAN, employers can transfer funds effectively by providing the new employer with their UAN and KYC information. When the employer verifies all the data, they can carry out PF transactions from the old account to the new one without any issues.

ii) Few Employers Participate in PF Withdrawals

- Prior to the introduction of UAN, employers had a dependency on PF withdrawal because they had to sign the application before sending it to EPFO.

- However, this dependence has decreased in the case of UAN. Once the KYC verification completes, the system automatically transfers the PF amount from the old account to the new one.

iii) Transactions Are Streamlined With Mobile Notification

- The UAN number offers quicker transactions and more security, which is one of its advantages. SMS notifications are available for withdrawals and the monthly employer contribution, as they are for all other PF account activities.

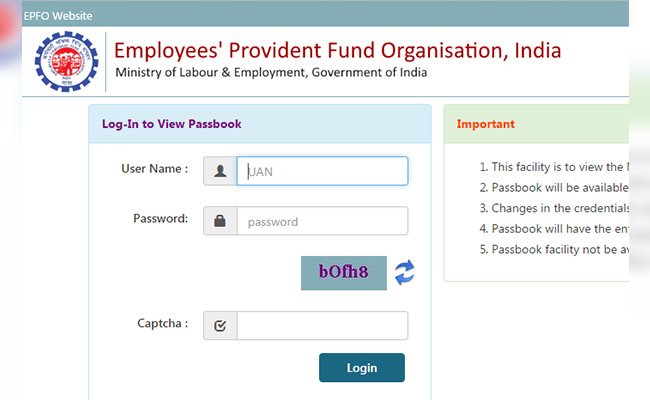

- Users can access UAN to view their account balances as well. They must download the PF passbook for this purpose from the EPF website.

iv) Advantages of the Employee Pension Plan

- Employees had to withdraw from the Employee Pension Scheme prior to the implementation of UAN, which had an impact on the retirement payout.

- With UAN, the system immediately moves the balances of both the Employers Provident Fund and the Employee Pension Scheme accounts to the new account, thereby increasing the amount at retirement.

- We have already talked about what a UAN number is and its advantages. Let’s now look at how to produce it.

4. UAN Login?

- People must be aware of the procedure for creating a Universal Account Number now that they are aware of what it is, how important it is, and what advantages it offers.

- To generate a UAN number, adhere to the instructions listed below.

- Step 1: Enter your Establishment ID and password to access the EPF Employer Portal.

- Step 2: Select “Register Individual” under the “Member” option.

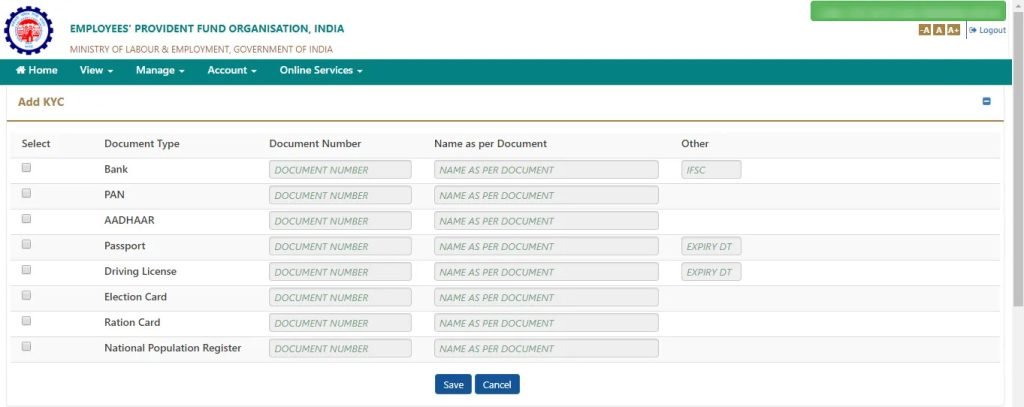

- Next Step 3: Provide employee information, including Aadhaar, PAN, and bank information.

- Step 4: Review all the information and then click the “Approval” button.

- Step 5: EPFO will produce a new UAN.

New employers can quickly link their employees’ Provident Fund accounts to their new UAN once it has been generated.

5. Documents Needed to Create a UAN

The complete list of documents needed to generate UAN is shown below.

- Identity documentation includes a driver’s license, passport, voter ID, etc.

- Address documentation may include a recent utility bill, rental or lease agreement, ration card, etc.

- IFSC code and account number for a bank account

- PAN Card

- ID card, Aadhaar

- ESIC Card

6. How do I verify my UAN number?

People have a variety of ways to check the details of their UAN numbers. which are

i) UAN Check via the Portal

- Step 1: Visit the EPFO’s Unified Member Portal.

- Step 2: Next, select the ‘Know Your UAN Status’ link under the area of key links. People would then see a new homepage where they must enter crucial information such as their name, birthdate, cell phone number, and email address as well as their current member ID or EPF account number.

- After, Step 3: After providing information, people will receive an authorization PIN on the registered mobile number.

- Step 4: People must now enter their PIN.

- Step 5: UAN will be sent to the registered email address and mobile number after this is entered.

ii) UAN Number Check by Mobile Number

Members and persons who have registered on the UAN portal can use the missed call feature to receive all the details. The procedure is simple to follow. Follow along!

- Step 1: From your registered mobile number, send a missed message to 011-22901406.

- Step 2: After two rings, this call will be immediately disconnected.

- Next, Step 3: As soon as the missed call is successfully placed, you will receive an SMS with all of the PF information.

It is important to keep in mind that this service is available to employees whose UAN has been connected with KYC information.

iii) Aadhaar Card Check UAN Number

You can use Aadhaar cards to check UAN as well.

- Step 1: Access the Unified Member Portal for EPFO

- Step 2: From the vital link box, choose “Know Your UAN Status.”

- After Next, Step 3: Choose Aadhaar and enter the phone number, name, birthdate, cellphone number, and email address.

- Step 4. Enter the Captcha code.

- Step 5: Choose “Get Authorization PIN”.

- Sixth step: A new page will be accessed by users. Check the information provided, then select “I agree.”

- Step 7: Please enter the OTP that was delivered to the contact number you registered.

- Step 8: After choosing “Validate OTP,” get the UAN.

A fresh message will be sent to your registered phone number, informing you that the UAN information has been delivered.

7. EPFO Login?

Individuals need to complete the instructions listed below in order to activate UAN EPFO.

- Step 1: Visit the EPF Member Portal.

- In step 2, select Activate UAN.

- The third step requires people to choose one of the three options—UAN, Aadhaar, or PAN, member ID.

- Step 4: Fill out the required fields with your name, birthday, email address, and phone number.

- Step 5: is to click “Get Authorization PIN.”

- Put the PIN in and choose “Validate OTP and Activate UAN” in step 6.

- Step 7: The registered mobile number will receive a message activating the UAN. As a result, activating EPFO UAN is simple.

Those who are aware of what a UAN number is, its advantages, significance, generation process, and activation procedure can now access all of their PF accounts quickly and effortlessly.

8. Conclusion

UAN login and the EPFO (Employees’ Provident Fund Organization) play crucial roles in providing employees with convenient access to their EPF (Employees’ Provident Fund) accounts and various benefits. The UAN portal serves as a centralized platform that enables employees to manage their EPF accounts, view their balance, download statements, and avail themselves of online services.

Also, Read Our Latest Blog Posts:

- The New Evolution of Telangana Secretariat and The Tallest Ambedkar Statue: Symbol of Equality and Justice

- A Wonderful Drive Trip On Outer Ring Road, Hyderabad

- Brief Info of Regional Ring Road, Hyderabad

- Exploring Hyderabad’s Mobility Valley: The Hub of Innovation and Connectivity

- Do You Know 13 Myths About HMDA Master Plan?

- Properties In Hyderabad

- Agriculture Land Near Hyderabad

- Villas Near Hyderabad

Frequently Asked Questions

Ans: The full form of UAN is Universal Account Number.

Ans: The full form of EPFO is Employees’ Provident Fund Organisation.

Ans: Whenever an employee makes a contribution to the Employees Provident Fund, they are given a 12-digit number known as a UAN.

Ans: UAN Login Portal is https://unifiedportal-mem.epfindia.gov.in/memberinterface/.