Understanding stamp duty and registration charges is crucial for anyone planning to buy property in Bangalore. These government levies form a significant portion of the overall property acquisition cost. Here’s a comprehensive breakdown of the current rates (as of June 1, 2024) to help you navigate the process smoothly.

Stamp Duty: A Graduated Charge

Bangalore follows a tiered structure for stamp duty, which is a tax levied on the property’s market value or consideration amount (whichever is higher). Here’s a clear segregation:

- Up to Rs. 20 lakh: For properties valued up to Rs. 20 lakh, you’ll pay a concessional rate of 2% as stamp duty.

- Rs. 21 lakh to Rs. 45 lakh: Properties falling within this bracket attract a stamp duty of 3%.

- Above Rs. 45 lakh: For luxury properties exceeding Rs. 45 lakh, the stamp duty rises to 5%.

Understanding Surcharge and Cess: Additional Layers

While the above rates provide a basic idea, there are additional charges to consider:

- Surcharge: An urban surcharge of 2% is applicable on the stamp duty for properties located in Bangalore’s urban areas. This means if you’re buying a property above Rs. 35 lakh, the effective stamp duty becomes 5.6% (3% + 2% surcharge + 10% cess – explained below).

- Cess: A 10% cess is levied on the stamp duty amount for all properties across Karnataka, irrespective of location.

Registration Fee: A Flat Rate

The registration fee is a flat 1% of the property’s market value or consideration amount, whichever is higher. This fee goes towards registering the property sale deed with the government authorities.

Example: Calculating the Total Cost

Let’s consider a property purchase in Bangalore for Rs. 40 lakh. Here’s how the charges would break down:

- Stamp Duty (excluding surcharge and cess): Rs. 40 lakh * 3% = Rs. 1,20,000

- Surcharge (applicable as the property is in the urban area): Rs. 1,20,000 * 2% = Rs. 2,400

- Cess: Rs. 1,20,000 * 10% = Rs. 12,000

- Registration Fee: Rs. 40 lakh * 1% = Rs. 40,000

Total Charges: Rs. 1,20,000 (Stamp Duty) + Rs. 2,400 (Surcharge) + Rs. 12,000 (Cess) + Rs. 40,000 (Registration Fee) = Rs. 1,74,400

Important Points to Remember

- Gender doesn’t affect stamp duty or registration charges in Bangalore.

- These charges are subject to change based on government notifications. It’s advisable to consult the official website of the Department of Stamps and Registration, Karnataka https://igr.karnataka.gov.in/english for the latest updates.

- Consulting a property lawyer can provide valuable guidance on calculating the exact charges applicable to your specific property purchase.

Factors that determine stamp duty charges:

- Property Value: The core factor influencing stamp duty is the property’s market value or agreement value (whichever is higher). Generally, a higher value translates to a higher stamp duty rate.

- Location: Stamp duty rates can vary significantly depending on the property’s location. Urban areas typically have higher rates compared to rural areas. This is because governments use stamp duty as a revenue source and urban properties tend to be more expensive.

- Property Type: The type of property, whether residential, commercial, or agricultural, can also impact the stamp duty rate. Some states might offer concessions for specific property types.

- Purpose of Transaction: The purpose of the property transaction, such as sale, inheritance, or gift, can influence the stamp duty rate in some states. Gift deeds often attract a higher rate compared to sale deeds.

- Gender and Age: While not applicable in Bangalore, a few states offer concessions on stamp duty for women or senior citizens.

Additional Factors (may vary by state):

- Ready Reckoner Rate (RNR): Some states use a government-determined RNR as a base for calculating stamp duty. The stamp duty is levied on whichever value is higher – the actual transaction value or the RNR.

- Circle Rates: Similar to RNR, circle rates set by local authorities might be used for stamp duty calculation in some states.

- Development Charges: A few states might levy additional development charges on top of the stamp duty.

House Registration charges in Bangalore 2024:

In Bangalore, house registration charges for 2024 are a simple and straightforward 1% levy. This fee is calculated based on the higher of the following two values:

- Market Value of the House: This is the estimated current market price of the house in its existing condition.

- Consideration Amount: This refers to the actual price agreed upon between the buyer and seller in the sale agreement.

Here’s a breakdown of the key points:

- Flat Rate: The registration charge is a flat 1%, regardless of the house size, location (within Bangalore), or the buyer’s profile.

- Purpose: This fee goes towards registering the sale deed of the house with the government authorities, officially transferring ownership rights.

- No Distinction: This 1% rate applies uniformly to both residential and commercial houses.

Example:

Consider a house purchase in Bangalore with a market value of Rs. 50 lakh and a consideration amount of Rs. 52 lakh in the sale agreement.

- Higher Value: In this case, Rs. 52 lakh (consideration amount) is higher than the market value.

- Registration Charge: Rs. 52 lakh * 1% = Rs. 52,000

Therefore, the house registration charge for this scenario would be Rs. 52,000.

land:

Land registration charges in Bangalore for 2024 are the same as house registration charges. They consist of a flat 1% fee levied on the property’s market value or consideration amount, whichever is higher.

Here’s why:

- In India, the term “land” often encompasses both vacant plots and constructed houses on land.

- The registration process for transferring ownership of both land and houses involves registering the sale deed with the government authorities.

- Therefore, the same registration fee structure applies to both scenarios.

There might be additional charges specific to land registration depending on the type of land (agricultural vs. non-agricultural) or purpose of the transaction (sale vs. gift). However, the 1% registration fee remains the same for both houses and land (unless there are specific exemptions based on land type or transaction purpose).

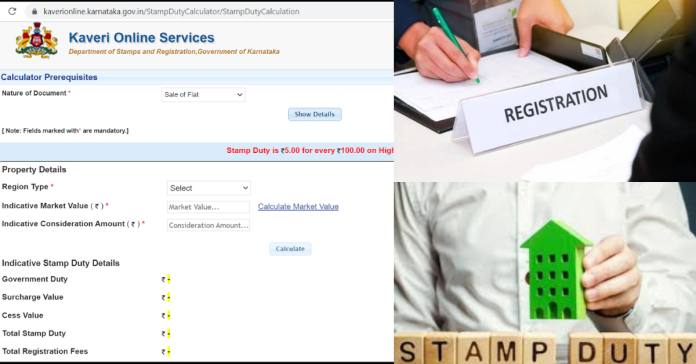

To know more about stamp duty charges Kaveri online services

Stamp Duty and Registration Charges for Conveyance Deed in Bangalore (2024)

For a conveyance deed involving a property purchase in Bangalore (as of June 1, 2024), the charges involve two main components:

1. Stamp Duty:

- This is a tax levied on the property’s market value or consideration amount (whichever is higher).

- The stamp duty rate depends on the property value:

- Up to Rs. 20 lakh: 2%

- Rs. 21 lakh to Rs. 45 lakh: 3% (This concession applies only to first-time property registrations)

- Above Rs. 45 lakh (Urban Areas): 5% + 2% surcharge + 10% cess (effectively 5.6%)

- Above Rs. 45 lakh (Rural Areas): 5% + 3% surcharge + 10% cess (effectively 5.8%)

2. Registration Fee:

- This is a flat 1% levied on the property’s market value or consideration amount (whichever is higher).

- This fee goes towards registering the conveyance deed with the government authorities.

Here’s a table summarizing the charges:

| Property Value Range | Stamp Duty (Urban) | Stamp Duty (Rural) | Registration Fee |

|---|---|---|---|

| Up to Rs. 20 lakh | 2% | 2% | 1% |

| Rs. 21 lakh to Rs. 45 lakh | 3% | 3% | 1% |

| Above Rs. 45 lakh | 5.6% | 5.8% | 1% |

Additional Points:

- Surcharge is applicable only in urban areas of Bangalore.

- Cess is a fixed 10% levied on the stamp duty amount across the state.

- These charges are subject to change based on government notifications.

Let’s look at an example:

Consider a property purchase in Bangalore for Rs. 50 lakh (located in an urban area).

- Stamp Duty: Rs. 50 lakh * (5% + 2% surcharge) = Rs. 3.5 lakh

- Cess: Rs. 3.5 lakh * 10% = Rs. 35,000

- Registration Fee: Rs. 50 lakh * 1% = Rs. 50,000

Total Charges: Rs. 3.5 lakh (Stamp Duty) + Rs. 35,000 (Cess) + Rs. 50,000 (Registration Fee) = Rs. 4,35,000

Stamp Duty and Registration Charges for Gift Deed in Bangalore (2024)

The charges for registering a gift deed in Bangalore differ significantly from those of a conveyance deed (property purchase). Here’s a breakdown of the costs involved:

Stamp Duty:

- The applicable rate depends on whether the recipient (donee) is a family member of the donor or not.

- Family Member: A fixed charge of Rs. 1,000 is levied, along with a surcharge and cess (calculated on Rs. 1,000).

- Non-Family Member: A steeper rate of 5% is applied to the property’s market value, followed by a surcharge and cess.

Registration Fee:

- A flat fee of Rs. 500 (fixed) is charged for gift deeds, irrespective of the recipient or property value.

- Additionally, a surcharge and cess are levied on the Rs. 500 fee.

Here’s a table summarizing the charges:

| Donee Relation | Stamp Duty | Registration Fee |

|---|---|---|

| Family Member | Rs. 1,000 + Surcharge & Cess | Rs. 500 + Surcharge & Cess |

| Non-Family Member | 5% of Market Value + Surcharge & Cess | Rs. 500 + Surcharge & Cess |

Important Points:

- Family Member Definition: Close relatives like spouse, children, parents, siblings, grandchildren, grandparents, and in-laws are generally considered family members for stamp duty purposes. It’s advisable to consult the official department website or a lawyer for a definitive list.

- Surcharge and Cess: These are additional charges levied on the stamp duty or registration fee. The surcharge applies only in urban areas of Bangalore (2% on stamp duty or Rs. 500), while the cess is a flat 10% levied on the entire stamp duty amount (or Rs. 500 for registration fee).

Let’s consider two scenarios:

- Gifting Property to a Spouse (Family Member):

- Stamp Duty: Rs. 1,000 + (Rs. 1,000 * 2% surcharge) + (Rs. 1,000 * 10% cess) = Rs. 1,120

- Registration Fee: Rs. 500 + (Rs. 500 * 2% surcharge) + (Rs. 500 * 10% cess) = Rs. 550

Total Charges: Rs. 1,120 (Stamp Duty) + Rs. 550 (Registration Fee) = Rs. 1,670

- Gifting Property to a Friend (Non-Family Member):

- Property Market Value: Rs. 40 lakh

- Stamp Duty: Rs. 40 lakh * 5% = Rs. 2,00,000

- Surcharge (applicable as the property is in the urban area): Rs. 2,00,000 * 2% = Rs. 4,000

- Cess: Rs. 2,00,000 * 10% = Rs. 20,000

- Total Stamp Duty: Rs. 2,00,000 + Rs. 4,000 + Rs. 20,000 = Rs. 2,24,000

- Registration Fee: Rs. 500 + (Rs. 500 * 2% surcharge) + (Rs. 500 * 10% cess) = Rs. 550

Total Charges: Rs. 2,24,000 (Stamp Duty) + Rs. 550 (Registration Fee) = Rs. 2,24,550

Stamp Duty and Registration Charges for Lease Deed in Bangalore (2024)

The stamp duty and registration charges for lease deeds in Bangalore differ from those of property purchases (conveyance deeds). Here’s a breakdown of the costs involved:

Stamp Duty:

- The rate depends on the duration of the lease and the type of property (residential or commercial/industrial).

Here’s a table outlining the general structure:

| Lease Term | Residential Property | Commercial/Industrial Property |

|---|---|---|

| Up to 1 year | 0.5% of Average Annual Rent (AAR) + Advance + Premium + Fine (Maximum Rs. 500) | |

| More than 1 year but less than 5 years | 2% of AAR + Advance + Premium + Fine (Minimum Rs. 500, Maximum Rs. 20,000) | |

| More than 5 years | As per conveyance deed (refer to previous sections for details) | 5% of AAR + Advance + Premium + Fine (Minimum Rs. 500, Maximum Rs. 20,000) |

Important Points:

- Average Annual Rent (AAR): This refers to the total rent payable for the entire lease period divided by the number of years.

- Advance, Premium, and Fine: Any advance rent payment, premium paid for securing the lease, or penalty for delayed rent payment are considered while calculating the stamp duty.

- The maximum and minimum limits mentioned are subject to change. It’s advisable to consult the official department website or a lawyer for the latest rates.

Registration Fee:

- A flat fee of 1% is levied on the total lease amount (AAR multiplied by the lease term) for both residential and commercial/industrial properties.

Example:

Consider a residential property lease in Bangalore for 3 years with the following details:

- Monthly Rent: Rs. 20,000

- Advance Rent: Rs. 1,00,000

Average Annual Rent (AAR): Rs. 20,000/month * 12 months = Rs. 2,40,000

Total Lease Amount: Rs. 2,40,000/year * 3 years = Rs. 7,20,000

Stamp Duty:

- Assuming there’s no premium or fine, the stamp duty would be:

- 2% of (Rs. 2,40,000 AAR + Rs. 1,00,000 Advance) = Rs. 8,800 (ensure you check the latest minimum/maximum limits)

Registration Fee:

- Registration Fee: Rs. 7,20,000 (Total Lease Amount) * 1% = Rs. 7,200

Total Charges: Rs. 8,800 (Stamp Duty) + Rs. 7,200 (Registration Fee) = Rs. 16,000

Stamp Duty and Registration Charges for Cancellation Deed in Bangalore (2024)

When a previously registered property agreement needs to be canceled, a Cancellation Deed comes into play. Here’s a breakdown of the charges involved in Bangalore for 2024:

Stamp Duty:

The stamp duty applicable for a cancellation deed depends on the type of original agreement being cancelled:

- Cancellation of a conveyance deed (sale agreement): This attracts the same stamp duty rate as the original conveyance deed. Remember, the conveyance deed rates were covered in a previous section. You can refer back to that section for details on tiered rates based on property value and additional charges like surcharge and cess (applicable in urban areas).

- Cancellation of any other instrument: Here, a fixed charge of Rs. 100 or 1% of the market value (whichever is higher) applies.

Registration Fee:

The registration fee for a cancellation deed is a flat Rs. 100, irrespective of the original agreement type or property value.

Here’s a table summarizing the charges:

| Original Agreement Type | Stamp Duty | Registration Fee |

|---|---|---|

| Conveyance Deed | Same as original conveyance deed | Rs. 100 |

| Any Other Instrument | Rs. 100 or 1% of market value (whichever is higher) | Rs. 100 |

Important Points:

- It’s crucial to have the original agreement readily available when registering the cancellation deed.

- The cancellation deed needs to be duly stamped and registered with the same sub-registrar’s office where the original agreement was registered.

- Consulting a property lawyer is recommended to ensure the cancellation process is executed smoothly and to navigate any complexities arising from the specific terms of the original agreement.

Frequently Asked Questions:

A: For properties up to Rs. 20 lakh, it’s 2%. For Rs. 21 lakh to Rs. 45 lakh (first-time registration only), it’s 3%. Above Rs. 45 lakh (urban areas), it’s 5% + 2% surcharge + 10% cess (effectively 5.6%). Rates differ slightly for rural areas.

A: Yes, a flat 1% fee is levied on the property’s market value or consideration amount (whichever is higher) for various transactions like house/land registration, lease deeds, and cancellation deeds.

A: Yes, for gift deeds, a fixed Rs. 500 fee applies, along with a surcharge (applicable in urban areas) and cess, calculated on the Rs. 500.

A: The stamp duty depends on the lease term and property type (residential or commercial/industrial). The registration fee is a flat 1% of the total lease amount.

A: The stamp duty depends on the type of original agreement being cancelled. The registration fee is a fixed Rs. 100. Consulting a lawyer is recommended for this process.

Suggested Articles:

Kaveri Online 2024 : Check EC Karnataka, Services, Stamp Duty Charges