1. Introduction

Greater Hyderabad Municipal Corporation (GHMC) is Greater Hyderabad’s municipal corporation. The GHMC guarantees that the inhabitants of Hyderabad have a solid physical infrastructure as well as outstanding social amenities. It offers a variety of services, including town planning, disaster management, the imposition and collection of property taxes, empty land taxes, the disbursement of trade licenses, the submission of building plan applications, fire safety certificates, and the transfer of development rights, among others.

The GHMC has implemented an online system for citizen services to deliver services from the convenience of one’s home.

Hyderabad city has been separated into five zones in order to deliver effective citizen-centric services. Hyderabad has five municipal zones: East Zone, West Zone, North Zone, South Zone, and Central Zone.

2. Services of GHMC

| Services provided by GHMC | ||

| Town Planning | Master Plan Development | Layout Regularisation |

| Fire NOC Sanction | LRS Status | Unauthorized Construction Information |

| Citizens Grievances Redressal | Property Tax Collection | Online Application for Trade License |

| Property Tax Search | Online Property Mutation Application | Mutation Abstract Report |

| Know Vacant Land Details | Vacant Land Tax Search | Urban Facilities Management |

| Sports and Playground Management | Community Centres Management | Birth and Death Certificate Services |

3. How can I find the Vacant Land Tax information on the GHMC portal?

- Go to the GHMC’s official website at https://www.ghmc.gov.in/ghmc.aspx.

- Click the ‘Our Services’ link on the home page.

- As a result of this, select ‘Know Your Land Tax Details’.

- A new page will be shown.

- Enter information such as the District, ULB, VLTIN Number, Owner’s Name, and Door Number.

- Select the ‘Search Vacant Land Tax’ option.

- On the screen, the tax amount for your unoccupied land will be revealed.

Click here to follow our WhatsApp channel

4. How does the GHMC calculate the unoccupied Land Tax?

The GHMC levies a vacant land tax in the following ways. The property owners/Registration Office should submit the Registered Documents of open plots to the GHMC. Upon completion of this process, the authorities will levy the Vacant Land Tax in accordance with the Act. The charge will be 0.5% of the land’s capital value. Following that, the Concerned Tax Inspector / Bill Collector will check the property to ensure that it has a clear title. Following then, the authorities will proceed to levy the vacant Land Tax in accordance with the laws.

5. How does the GHMC change the property tax?

To change your property tax in Hyderabad, go to the Commissioner and Director of Municipal Administration (CDMA) website. The GHMC modifies the property tax in the following steps:

Step 1: Navigate to the following URL: https://cdma.cgg.gov.in/CDMA_PT/Mutation/Index.

Step 2: The applicant completes the Mobile OTP Validation to gain access to the Mutation Application Form.

Next, Step 3: The applicant must complete the required information and submit the required document.

Step 4: After the applicant submits the form, the system generates an Application ID and sends an SMS to provide additional instructions.

Step 5: The Revenue Inspector (RI) verifies and approves. The Revenue Officer (RO) reviews and approves the application.

After, Step 6: The Revenue Officer (RO) verifies and authorizes. The Municipal Commissioner (MC) reviews the application.

Step 7: Verification and approval by the Municipal Commissioner (MC). Following MC clearance, the

A payment link will be SMSed to the applicant/citizen.

Step 8: The citizen makes the payment, and the Mutation is completed upon receiving the money.

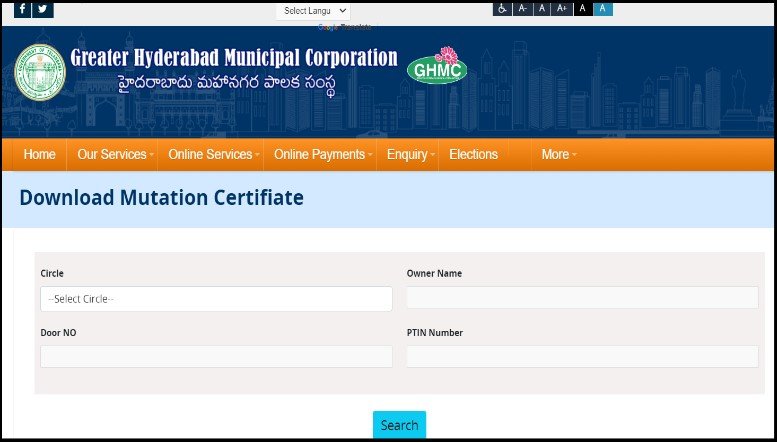

6. How do I get mutation certificates from the GHMC portal?

Citizens can get the mutation certificate from the GHMC website. Follow the steps below to obtain the mutation certificate.

Step 1: Navigate to the GHMC portal at https://www.ghmc.gov.in/ghmc.aspx.

Step 2: On the webpage, go to the Property tax tab and choose Mutation.

Next, Step 3: Select the Download Mutation Certificate option from the GHMC menu.

Step 4: This will open in a new window.

Step 5: Select a Circle name, an Owner name, a Door number, and a PTIN number.

Last, Step 6: Press the Search button. On the screen, the mutation certificate will be presented. It is now available for download.

Houses / Villas / Open Plots In Hyderabad

7. How can I find out what the Layout Registration Scheme Status (LRS Status) is on the GHMC portal?

Follow the steps below to check the status of your LRS on the GHMC portal.

- Navigate to the GHMC website.

- Click the town planning tab on the site.

- Select the LRS status option.

- A new window will be launched.

- Enter the LRS Number, Circle, and Year in this window.

- Select the Search option.

- The status of the LRS will be displayed on the screen.

8. GHMC Contact Information

The headquarters of the Greater Hyderabad Municipal Corporation are in Hyderabad. GHMC’s contact information is as follows:

Hyderabad Metropolitan Municipal Corporation

Hyderabad, 500063, CC Complex, Tank Bund Road, Lower Tank Bund

Phone: 040- 23225397, Helpline: 21111111

Also, Read Our Latest Blog Posts:

- Unlocking Opportunities: Top Cities in India for NRI Real Estate Investment

- Luxury Residence Sales Surge: 97% Growth in India’s Major Cities

- Meter to Kilometer Convert Online

- Take a Look at Hyderabad ORR Exit Number 12 – Bonguluru

- MP E-District Portal: Services, Registration Process, and Essential Documents

Frequently Asked Questions

Ans: GHMC provides services such as town planning, disaster management, property tax collection, trade licenses, and birth/death certificate services.

Ans: GHMC levies 0.5% of the land’s capital value, following verification of clear title by the Concerned Tax Inspector/Bill Collector.